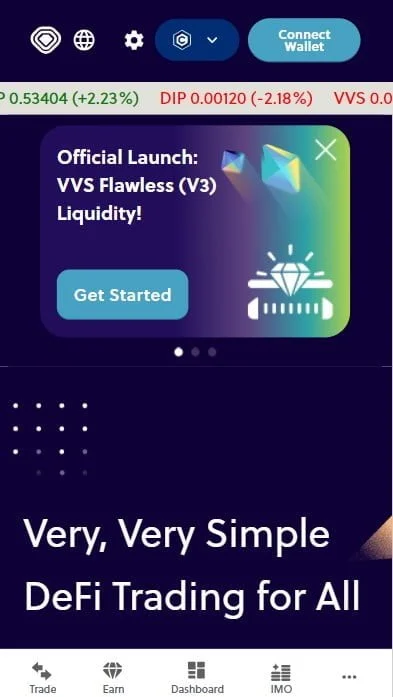

VVS Finance: Revolutionizing DeFi with High-Yield, Low-Fee Trading

VVS Finance is a decentralized exchange (DEX) built on the Cronos blockchain, designed to provide users with a simple and rewarding platform for swapping and earning yields. It utilizes the Automated Market-Making (AMM) model, offering efficient trades and liquidity provision. The exchange stands out by offering low transaction fees, fast transaction speeds, and attractive incentive programs, making it a powerful tool for DeFi users.

Key Features of VVS Finance:

1. AMM-Driven Swap and Yield Generation:

- Simple Swapping: VVS Finance simplifies the process of swapping digital assets with its AMM-powered liquidity pools. Users can seamlessly swap tokens at the best available rates.

- Liquidity Pools: Liquidity providers (LPs) can contribute their tokens to pools and earn a share of swap fees. As an LP, you’ll receive a portion of the fees generated by trades in your pool, ensuring you earn passive income by simply providing liquidity.

2. Built on the Cronos Blockchain:

- Low Fees & High Speed: VVS Finance operates on the Cronos blockchain, which boasts low transaction fees and high throughput, making it ideal for users seeking efficient and cost-effective decentralized trading and yield farming.

3. Incentive Programs for Stakeholders:

- Liquidity Providers (LPs): ⅔ of all swap fees collected on VVS Finance are distributed to LPs who provide liquidity in the platform’s pools. In addition to swap fees, LPs can stake eligible LP tokens in the “Crystal Farm” tab to earn VVS rewards.

- VVS Stakers: Users can stake VVS tokens in the “Glitter Mine” tab to earn VVS rewards as well as rewards from partner tokens.

- Trading Incentives: VVS Finance rewards users who engage in token swaps on the platform, with specific reward details to be announced soon.

- Referral Program: Users who refer others to trade on the platform will also be eligible for rewards, creating an additional earning opportunity within the VVS ecosystem.

4. VVS Governance Token:

- The VVS token serves as the native governance token of VVS Finance. It plays a key role in the platform’s incentive structure and allows holders to participate in community governance decisions, helping to shape the future of the platform.

5. Sustained Rewards and Community Engagement:

- A significant portion of the VVS supply is reserved for future community initiatives and rewards, ensuring that the VVS Finance ecosystem remains vibrant and sustainable in the long term. This ensures that users who contribute to the platform’s success can benefit from the growth and success of VVS Finance.

How to Earn on VVS Finance:

- Liquidity Provision: By adding liquidity to pools, LPs can earn swap fees. If you choose to stake your LP tokens in the Crystal Farm, you’ll earn additional VVS rewards on top of the swap fees.

- Staking VVS: Users can stake their VVS tokens in the Glitter Mine tab, which rewards them with more VVS and partner tokens, depending on the available farming opportunities.

- Trading Incentives: Swap tokens on VVS Finance to earn rewards. Specific details on trading incentives and reward structures will be shared soon.

- Referral Program: Refer new users to the platform, and both you and the referred user can earn rewards for each successful transaction.

Why Use VVS Finance?

- Efficiency: VVS Finance combines the efficiency of the AMM model with the Cronos blockchain to offer a fast and low-cost experience.

- Attractive Rewards: The Crystal Farm and Glitter Mine allow users to earn additional rewards through liquidity provision and staking.

- Community-Driven: The VVS token not only powers the platform’s rewards system but also enables community governance, allowing token holders to influence the future of the platform.

- Incentivized Trading: VVS Finance continuously introduces new ways for users to earn by trading, referring, and providing liquidity.

Eyad –

good

MINi YOONJI –

Good