LI.FI: Multi-Chain Liquidity Aggregation for Seamless Cross-Chain Swaps

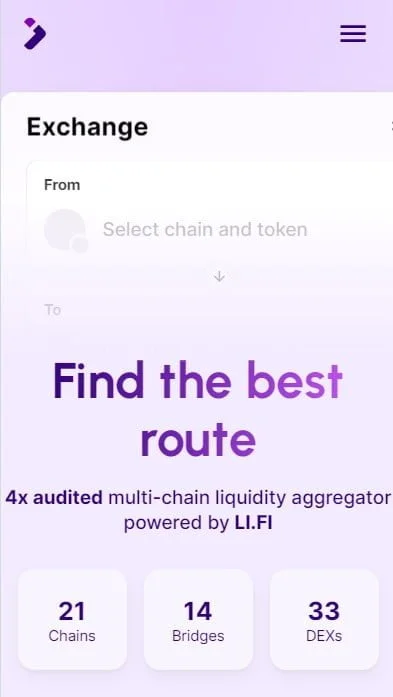

LI.FI is a cutting-edge liquidity aggregation protocol designed to simplify and enhance cross-chain swaps, offering a unified interface for connecting decentralized finance (DeFi) protocols and exchanges across more than 20 networks. By aggregating bridges and DEX aggregators, LI.FI empowers developers, applications, and traders with seamless access to multi-chain liquidity, supporting any-to-any swaps in a decentralized and cost-effective manner.

Key Features and Offerings

1. Multi-Chain Liquidity Aggregation:

LI.FI aggregates liquidity from multiple bridges and DEX aggregators across over 20 blockchain networks, enabling seamless cross-chain swaps. By connecting disparate chains and liquidity sources, LI.FI ensures that users have access to the best possible pricing and liquidity, no matter which chains or tokens are involved.

- Supported Networks: Over 20 chains supported, including Ethereum, Binance Smart Chain (BSC), Avalanche, Solana, and more.

- Any-to-Any Swaps: Users can swap assets across any two blockchains, regardless of the assets or networks involved.

2. SDK & API Integrations:

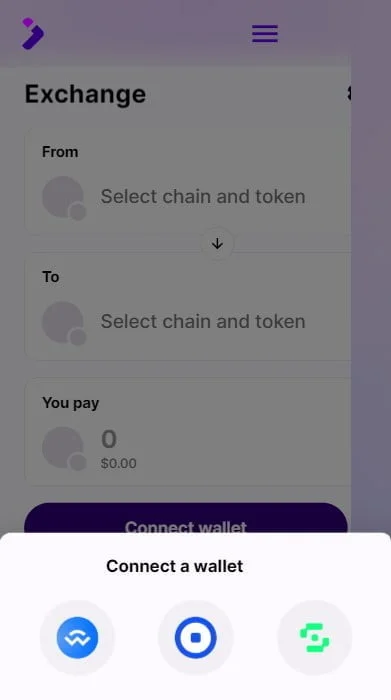

LI.FI provides JavaScript/TypeScript (JS/TS) SDK and REST API solutions that allow developers to integrate liquidity aggregation and swap functionalities into their applications quickly and easily.

- SDK (JS/TS): Can be implemented in any front-end or back-end, allowing you to customize and build your own user interface around LI.FI’s core functionalities. It provides seamless communication between the smart routing API and smart contracts, including robust event and error handling.

- REST API: Offers deeper integration capabilities, allowing for customizations and advanced features. The API provides detailed information about available routes, swaps, and the state of the aggregated liquidity.

- Pre-configured Widget: For those who need a quick solution, LI.FI provides an easily deployable widget that can be embedded on websites. This pre-configured widget allows users to quickly swap tokens across chains without requiring any backend integration.

Security and Centralization vs. Decentralization

Smart Contracts and Backend Architecture:

- Smart Contracts: LI.FI’s smart contracts operate decentralized, ensuring that the core functionality is trustless and secure. These smart contracts are open-source, offering transparency and flexibility for developers and auditors.

- Backend Centralization: While the smart contracts are decentralized, LI.FI’s backend remains centralized, which is crucial for fast data processing and efficient transaction computation. Blockchain technology, while secure, is not yet capable of processing the high volume of data needed for seamless and rapid swaps without incurring prohibitively high gas costs. By centralizing the backend, LI.FI can ensure that swaps are executed quickly and at low cost.

- Why Centralization? The need for fast and cost-effective processing, as blockchain transactions can become prohibitively expensive (in terms of gas fees) if executed on-chain. However, the team is actively exploring ways to decentralize the backend in the future, as technology and infrastructure evolve.

Future Decentralization Plans:

LI.FI is keeping an eye on projects that are working toward decentralizing infrastructure for large-scale data processing, particularly within the DeFi ecosystem. If suitable solutions emerge, LI.FI is open to transitioning its backend to a more decentralized model.

Liquidity Management and Bridge Aggregation

Bridge Aggregation:

At the heart of LI.FI’s approach is its bridge aggregation protocol. The protocol enables liquidity to flow between various blockchain networks seamlessly by using multiple bridges to ensure that users have access to the most reliable and liquid paths for their swaps.

- Bridge Prioritization: LI.FI allows you to manually and automatically prioritize certain bridges or DEX aggregators based on various factors, such as trustworthiness, transaction speed, cost, and other qualitative factors. This flexibility ensures that users can fine-tune their liquidity sources based on their specific needs.

- Fallback Solutions: LI.FI always ensures that a fallback solution is in place. If liquidity on one bridge is unavailable or if a bridge is compromised (e.g., in case of a hack), users can still access alternative liquidity sources, minimizing disruptions to their swaps.

Bridge Grading System:

Each bridge and liquidity source is graded based on a combination of qualitative and quantitative factors:

- Qualitative Factors: Trust assumptions, attack vectors, and security considerations.

- Quantitative Factors: Speed, fees, reliability, and gas costs.

The protocol uses an algorithm to dynamically adjust decisions based on these factors. By default, the protocol follows a prioritization pattern of security > speed > costs, ensuring a balance between reliability and performance.

- Customizable Prioritization: Users can adjust the prioritization pattern according to their preferences, such as opting for lower fees or prioritizing a specific bridge or protocol.

Whitelisting and Blacklisting Bridges:

LI.FI supports whitelisting and blacklisting of certain bridges, allowing users or protocols to control which bridges are used for liquidity aggregation. This adds an additional layer of customization and control over which protocols are trusted and utilized.

Why LI.FI Matters in the Multi-Chain Future

As the blockchain ecosystem grows, so does the number of networks and liquidity sources. While Ethereum remains a dominant force, multiple other chains are emerging with their own ecosystems, such as Solana, Avalanche, and new rollup technologies (e.g., zk-rollups and optimistic rollups). These chains present a fragmented liquidity landscape that needs to be bridged for cross-chain functionality to remain efficient.

LI.FI offers a one-stop solution for bridging liquidity between different blockchains, whether for institutional traders, DeFi protocols, or end-users. By offering multi-chain swaps, liquidity aggregation, and customizable integrations, LI.FI ensures that users have the best experience regardless of the blockchain they choose to trade on.

LI.FI is a powerful protocol for cross-chain liquidity aggregation, offering multi-token, any-to-any swaps and seamless integration through SDKs and APIs. Its unique bridge aggregation protocol and prioritization system offer high flexibility and security, ensuring that users always have access to the best liquidity and pricing for their swaps.

While the backend is centralized for now, LI.FI is committed to keeping an eye on future innovations that could enable further decentralization of its infrastructure. As the blockchain ecosystem continues to evolve, LI.FI will play a key role in enabling efficient liquidity bridging and cross-chain interoperability, providing both developers and users with the tools they need to navigate the rapidly growing world of multi-chain DeFi.

Harran –

nice

Eyad –

good

Ainsley Taai –

Good