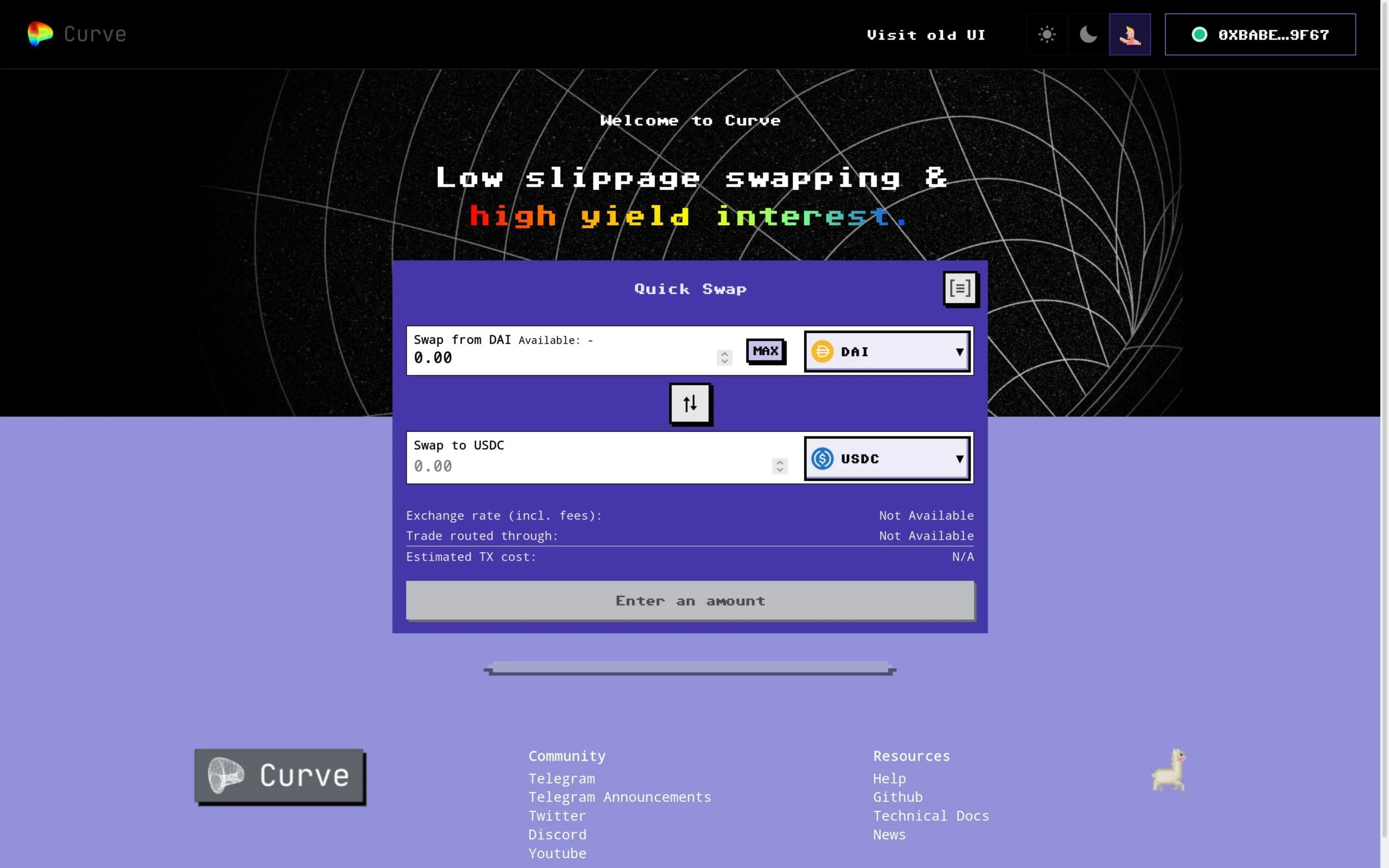

Curve Finance – Decentralized Exchange (DEX) and Automated Market Maker (AMM)

Curve Finance is a leading decentralized exchange (DEX) and automated market maker (AMM) optimized for the efficient trading of stablecoins and volatile assets. It is deployed on Ethereum and various EVM-compatible sidechains/L2s, allowing users to swap between a range of assets with low slippage and minimal fees.

Key Features of Curve Finance:

- Efficient Trading of Stablecoins: Curve specializes in providing low-slippage trades for stablecoins, making it an ideal platform for users looking to trade between stable assets like USDC, DAI, and USDT.

- Volatile Asset Trading: Curve also supports the trading of volatile assets, allowing users to engage in a wide range of decentralized exchanges.

- Unique Stablecoin (crvUSD): Curve has launched its own stablecoin, crvUSD, designed to function seamlessly within the Curve ecosystem.

- Curve Lending & LLAMMA Mechanism: Curve Lending allows users to lend assets and earn interest, while the LLAMMA (Liquidity Layer Automated Market Making) mechanism introduces a unique liquidation process that enhances liquidity management and risk mitigation.

Security & Auditing:

- Curve’s smart contracts have been audited by Trail of Bits to ensure security. However, audits don’t eliminate all risks, so it’s important not to supply assets you can’t afford to lose, particularly when providing liquidity.

How to Trade on Curve Finance:

- Approve Curve to Access Your Funds:

- Before trading, you will need to approve Curve to interact with your stablecoin balance (similar to how most DeFi applications work).

- Select Assets to Swap:

- On the exchange page, choose the asset you want to convert (e.g., USDC) and the quantity (e.g., 1,000). The platform will show you the exchange rate, the amount you will receive (after slippage and fees), and the transaction details.

- Execute the Trade:

- Once everything looks good, you can execute the trade. The powerful AMM design of Curve ensures that you receive a competitive exchange rate.

Liquidity Provision & Farming on Curve:

- Liquidity Pools:

- Curve uses cTokens or yTokens as the underlying assets for liquidity provision. These tokens allow your assets to be put to work while participating in market-making.

- Supported Stablecoins:

- You can deposit stablecoins such as DAI, USDC, USDT, TUSD, BUSD, and sUSD into Curve’s liquidity pools. These stablecoins are automatically converted into cTokens or yTokens for use in various pools.

- Depositing BTC:

- Curve also supports the deposit of Bitcoin ERC20 tokens, such as renBTC, WBTC, and sBTC, into specific liquidity pools.

- Yield Generation:

- By providing liquidity, you can earn a portion of the transaction fees as rewards. Fees are typically 0.04%, with half going to liquidity providers and the other half distributed to veCRV holders (DAO members).

How to Withdraw Liquidity from Curve:

- Withdraw Page:

- Navigate to the withdraw page on the platform.

- Partial Withdrawal:

- You can withdraw a percentage of your liquidity by entering the desired percentage in the top field. This is the preferred method for withdrawing.

- Full or Individual Coin Withdrawals:

- Alternatively, you can withdraw your liquidity in the form of individual coins like USDC, DAI, etc. The platform will perform the exchange for you, and you may incur an exchange fee.

- Fees:

- Remember, withdrawing in individual coins will come with a transaction fee. The fee for withdrawing from liquidity pools depends on the pool parameters set by the Curve DAO.

How Fees Work:

- Fee Distribution:

- The fee on all pools is 0.04%. Half of this fee goes to liquidity providers, and the other half is allocated to veCRV holders, who are members of the Curve DAO.

- Pool Parameters:

- The Curve DAO manages the parameters for each liquidity pool. These parameters can evolve over time as community governance decisions are made.

Common Curve Terminology:

- Maximum Amount of Coins Available:

- This option uses all available USDC or DAI in your wallet for the transaction. This method is recommended only if your wallet has significantly less liquidity than the amount currently in the pool.

- Infinite Approval:

- This feature pre-approves the contract to access your funds, meaning you won’t have to approve the amount every time you interact with Curve. While convenient, it’s important to only use this for trusted contracts.

Important Considerations:

- Security Reminder:

- Even though Curve has undergone audits, there are still inherent risks, especially when providing liquidity. Always evaluate risks based on your own risk tolerance, and never invest assets you cannot afford to lose.

- Trading on Curve:

- As a trader, using Curve is generally low-risk, but the platform’s nature as a decentralized exchange still exposes users to smart contract and market risks.

For more information on Curve Finance, how to use the platform, and stay updated with new developments, visit their official website or explore their community channels.

vorbelutrioperbir –

It is in point of fact a great and useful piece of info. I am happy that you simply shared this helpful info with us. Please stay us informed like this. Thank you for sharing.

Harran –

👍

Eyad –

ok

Reiny Brocka –

Great !