About GMX

What is GMX?

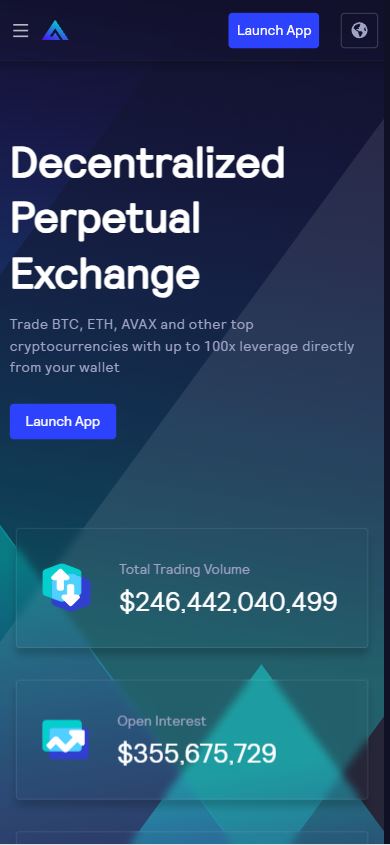

GMX is a decentralized exchange (DEX) designed for trading perpetual cryptocurrency futures with up to 50x leverage. Launched in September 2021 under the name Gambit Exchange, GMX has grown to become a leader in the derivatives DEX space, operating on the Arbitrum and Avalanche blockchains. The platform facilitates the trading of popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and others. It has achieved a total trading volume of over $130 billion and has attracted more than 283,000 users.

How Does GMX Work?

GMX operates differently from centralized exchanges (CEXs) and other decentralized exchanges (DEXs) by utilizing an innovative approach to the automated market maker (AMM) model. Rather than relying on an order book system, GMX features a native multi-asset liquidity pool called GLP, which is used to generate revenue for liquidity providers.

GLP is a multi-asset pool comprising assets like ETH, BTC, LINK, UNI, USDC, USDT, DAI, and FRAX. Prices within the GMX platform are determined by Chainlink’s price oracles, which gather price data from top exchanges. This model eliminates the need for traditional order books and allows GMX to offer leveraged trading with liquidity provided by the GLP pool.

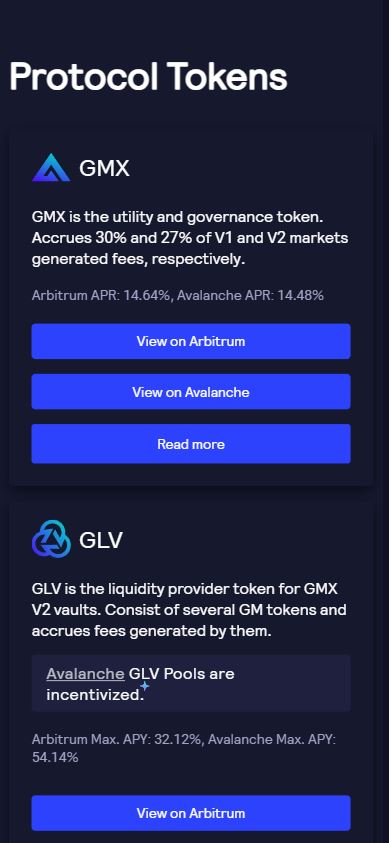

GMX operates on two tokens: GMX and GLP. GLP serves as the liquidity token, and its value reflects the combined worth of all the assets within the GMX ecosystem. GMX, on the other hand, is the utility and governance token, enabling token holders to participate in decisions affecting the platform’s future.

What Makes GMX Unique?

- Leverage and Liquidity: Users can add liquidity by minting GLP and earn a portion of the fees generated on the platform. Unlike many other liquidity pools, GLP does not experience impermanent loss, making it an attractive option for liquidity providers. Furthermore, the GLP pool acts as a counterparty for leveraged traders, meaning liquidity providers can profit when traders incur losses, and vice versa.

- Governance and Utility: The GMX token is used for governance, allowing holders to vote on platform updates and decisions. This provides a decentralized, community-driven approach to the development of GMX.

- Decentralization and Security: GMX operates on the Arbitrum and Avalanche blockchains. Arbitrum is a layer-2 blockchain that enhances Ethereum’s security, while Avalanche uses a directed acyclic graph (DAG) protocol to process transactions quickly and securely. GMX also prioritizes security, with its contracts audited by ABDK Consulting and an active bug bounty program on Immunefi.

Tokenomics and Supply

As of the latest update, the circulating supply of GMX is over 8.7 million tokens, with a maximum supply of 13.25 million. The distribution of GMX tokens is as follows:

- 6 million GMX for XVIX and Gambit migration

- 2 million GMX paired with ETH for liquidity on Uniswap

- 2 million GMX set aside for vesting via Escrowed GMX rewards

- 2 million GMX for a floor price fund

- 1 million GMX for marketing, collaborations, and community development

- 250,000 GMX for the team, distributed linearly over 2 years

History of GMX

GMX was originally launched as Gambit Exchange in September 2021, with an anonymous founding team. The lead developer is believed to be @xdev_10 on Twitter. Over time, GMX has evolved and integrated with the Arbitrum and Avalanche blockchains, benefiting from the unique security features of both ecosystems. The platform’s contracts have undergone security audits, and it is committed to maintaining a high level of transparency and security.

Conclusion

GMX offers a decentralized and innovative approach to leveraged cryptocurrency trading, combining multi-asset liquidity pools, secure blockchain technology, and a community-driven governance model. By operating on Arbitrum and Avalanche, GMX is able to offer faster and more secure transactions while providing opportunities for liquidity providers to earn rewards. The platform’s unique features and robust security measures make it a standout player in the decentralized finance (DeFi) space.

Harran –

decentralized exchange DEX👍👍👍