What is THORChain? (RUNE)

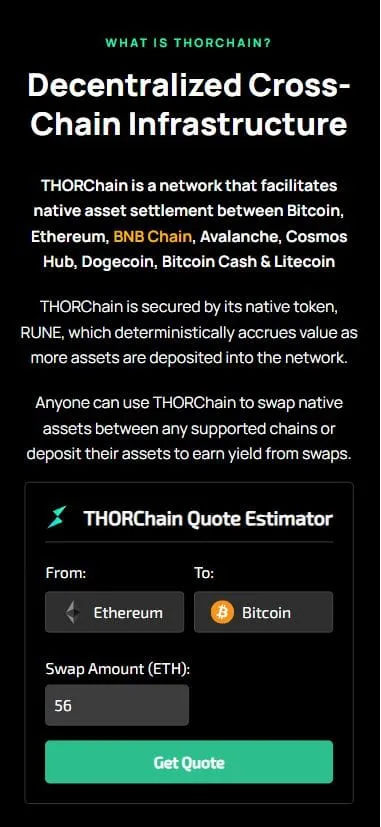

THORChain (RUNE) is a decentralized cross-chain liquidity protocol designed to enable users to swap assets between blockchain networks. Unlike many other decentralized exchanges (DEXs), which are limited to swapping assets within the same blockchain (e.g., Ethereum tokens for other Ethereum tokens), THORChain allows the seamless exchange of assets across different blockchains, such as Bitcoin, Ethereum, and Litecoin, without the need for a centralized intermediary.

THORChain leverages an automated market maker (AMM) model, which is the core technology enabling liquidity pools to facilitate trading without order books. THORChain stands out by offering cross-chain interoperability, solving the problem of non-interoperability between various blockchains, which is a major challenge in the decentralized finance (DeFi) space.

The RUNE token is the native token of the THORChain network. It acts as the pairing token that accompanies each asset in the liquidity pools, driving both the utility and value of the network. RUNE is also used for fees, governance, and network security through staking.

Key Features and Use Cases

- Cross-Chain Liquidity:

One of THORChain’s most significant innovations is its ability to facilitate cross-chain swaps. Users can trade assets between different blockchains without needing to rely on wrapped tokens, bridges, or centralized exchanges. For example, users can swap BTC for ETH or LTC for USDT directly within the THORChain network. - Automated Market Maker (AMM):

THORChain uses an AMM model to allow users to trade assets directly against liquidity pools. Each pool consists of two assets: RUNE and another asset. This is different from most AMMs, which often require pairs of assets that are specific to a blockchain. For example, if a user wants to swap USDT for ETH, the trade occurs through two steps: USDT → RUNE, then RUNE → ETH. RUNE acts as the intermediary, maintaining liquidity and driving the protocol’s efficiency. - Continuous Liquidity Pool (CLP):

THORChain uses a Continuous Liquidity Pool (CLP) model, where liquidity is always available for trading. The protocol adjusts automatically to fluctuating liquidity demand, ensuring that there is always enough liquidity in the pools to handle swaps, even during high-demand periods. - RUNE as the Native Token:

The RUNE token serves several purposes within the THORChain ecosystem:- Pairing Asset: RUNE is always paired with another asset in the liquidity pools (e.g., BTC-RUNE, ETH-RUNE).

- Governance: RUNE holders have voting rights in the governance of the protocol, allowing them to propose and vote on changes to the network.

- Security and Staking: RUNE is used for staking to secure the network. Node operators bond RUNE to support the network’s consensus mechanism.

How Does THORChain Work?

THORChain is built on the Cosmos SDK, which gives it the ability to connect with various blockchains. The protocol uses liquidity pools to allow users to swap assets across blockchains. Here’s how it works:

- Liquidity Pools:

Each liquidity pool on THORChain pairs RUNE with an asset from a supported blockchain (e.g., BTC-RUNE, ETH-RUNE). Liquidity providers (LPs) supply assets to these pools in return for rewards, which come from transaction fees and the block rewards generated by the protocol. - Cross-Chain Swaps:

When a user wants to swap assets (e.g., USDT for ETH), they execute the trade in two stages:- The user first trades USDT for RUNE in one liquidity pool.

- Then the RUNE is swapped for ETH in the next liquidity pool. This process happens automatically in the background, and the user does not need to handle RUNE directly.

- Role of Arbitrage Traders:

Arbitrage traders play a key role in maintaining the accuracy of asset prices on THORChain. These traders monitor price discrepancies between THORChain and other exchange platforms. When they identify an undervalued or overvalued asset, they buy or sell assets across different exchanges to rebalance the liquidity pools and bring the price back in line with the broader market. - Node Operators and Staking:

Node operators are essential to securing the THORChain network. They bond a certain amount of RUNE to participate in the Proof-of-Stake (PoS) consensus mechanism. These nodes process transactions and validate blocks in the network. The reliability of these operators is crucial, and they are rotated regularly in a process known as “churning.”

Roles within THORChain:

- Liquidity Providers (LPs):

LPs deposit assets into the liquidity pools and, in return, earn rewards from transaction fees and block rewards. The rewards LPs earn are proportional to their share in the liquidity pool and the trading activity that takes place within the pool. - Swappers:

Swappers are users who trade assets on THORChain by swapping between different liquidity pools. They do not need to manage RUNE directly but can benefit from cross-chain asset swaps. - Arbitrage Traders:

Arbitrage traders take advantage of price discrepancies between THORChain and other exchanges, ensuring that prices on THORChain align with broader market prices. These traders help maintain liquidity and efficiency in the pools. - Node Operators:

Node operators support the network by validating transactions and securing the blockchain. They bond RUNE to participate in the consensus mechanism and earn rewards for their efforts. Their reliability is key to the network’s trustworthiness.

THORChain’s Development and History

- Origins:

THORChain was first conceptualized by a team of developers at the Binance Dexathon in 2018. The project began as a solution to the liquidity fragmentation issue in decentralized exchanges, enabling cross-chain swaps directly between different assets. - Early Milestones:

THORChain raised $1.5 million in an initial DEX offering (IDO) in July 2019. In the same month, they introduced BEPSwap, a DEX for BEP-2 tokens on the Binance Chain. - The Multichain Chaosnet (MCCN):

In April 2021, THORChain launched its Multichain Chaosnet (MCCN), which enabled cross-chain swaps between Bitcoin, Ethereum, Litecoin, and other assets. This was a major step in the development of the protocol. - Security Challenges:

THORChain faced several security setbacks in 2021, including back-to-back hacks resulting in losses of over $13 million. Despite this, the team worked diligently to address vulnerabilities and strengthen the network’s security. By October 2021, the network had restored 4 of the 5 chains it supported and regained user confidence. - Continued Development:

The protocol has continued to evolve with new partnerships, integrations, and updates. A $3.75 million private token sale in October 2021, led by IDEO CoLab Ventures, bolstered the development efforts, ensuring the future of the project.

Reviews

There are no reviews yet.