About SushiSwap (SUSHI)

What is SushiSwap (SUSHI)?

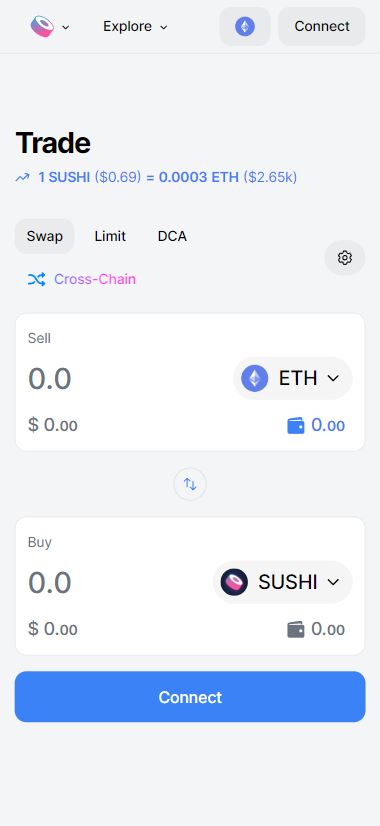

SushiSwap (SUSHI) is a decentralized exchange (DEX) and automated market maker (AMM) that operates on the Ethereum network. It allows users to trade cryptocurrencies directly using liquidity pools instead of relying on traditional order books. SushiSwap was launched in September 2020 as a fork of Uniswap, another popular AMM, with the goal of diversifying the AMM market and offering additional features like governance, rewards, and enhanced liquidity incentives via its native token, SUSHI.

SushiSwap’s decentralized nature means that users maintain control of their funds throughout the process, unlike centralized exchanges, where users must deposit funds into the exchange’s custody. The platform is community-driven, and its governance is handled by SUSHI token holders, giving them the power to propose and vote on platform upgrades and protocol changes.

How Does SushiSwap (SUSHI) Work?

SushiSwap operates as an AMM, which means it uses smart contracts to automatically execute trades between cryptocurrency assets without needing order books or a central intermediary. Here’s how it works:

- Liquidity Pools:

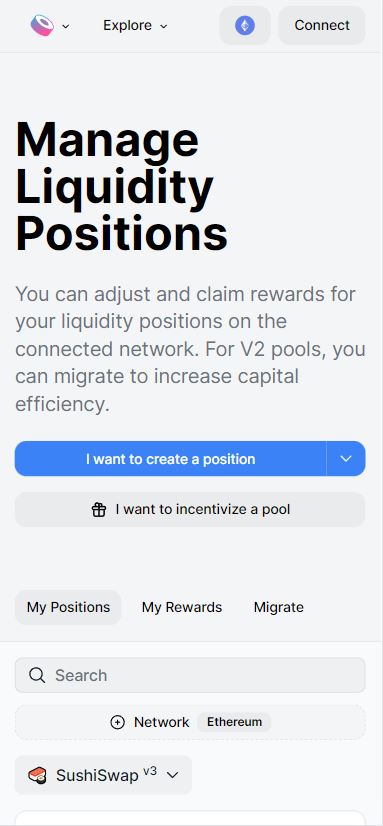

- SushiSwap’s core feature is its liquidity pools, which consist of two cryptocurrencies provided by liquidity providers (LPs). For example, a pool might contain an equal value of ETH and USDT.

- Users can contribute their own assets to these pools, and in return, they receive LP tokens that represent their share of the pool.

- Liquidity providers (LPs) are incentivized with rewards in the form of transaction fees from trades that occur in the pool. SushiSwap charges a 0.3% fee on each transaction, and a portion of this fee is distributed to the LPs.

- Yield Farming:

- Liquidity providers can stake their LP tokens into yield farms to earn additional rewards in SUSHI tokens, creating an added incentive to provide liquidity.

- Yield farming allows users to earn passive income by providing liquidity to the platform, which in turn supports the overall decentralized ecosystem.

- SUSHI Token:

- The SUSHI token serves multiple purposes within the SushiSwap ecosystem:

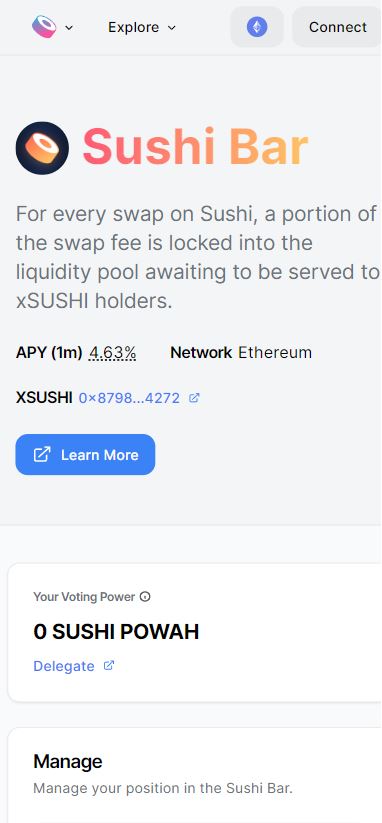

- Governance: SUSHI holders can vote on proposals and make decisions regarding the development of the platform, such as new features, improvements, or the addition of new liquidity pools.

- Rewards: SUSHI tokens are distributed to liquidity providers as a reward for contributing to the liquidity pools and participating in yield farming.

- Staking: Users can stake SUSHI tokens to earn more SUSHI over time, providing further incentives for holding the token.

- The SUSHI token serves multiple purposes within the SushiSwap ecosystem:

- No Centralized Control:

- SushiSwap is decentralized, meaning there is no central authority controlling the exchange. Decisions are made by the community of SUSHI token holders via governance proposals.

Potential Use Cases for SushiSwap (SUSHI)

SushiSwap (SUSHI) offers several key use cases for traders, liquidity providers, and investors within the decentralized finance (DeFi) space:

- Trading and Liquidity Provision:

- Crypto Trading: Users can trade a variety of cryptocurrencies without the need for intermediaries. Trades happen directly between tokens in liquidity pools, ensuring decentralized trading.

- Liquidity Provision: Users can add liquidity to pools and earn rewards in SUSHI tokens. This is a way to contribute to the platform while earning passive income through transaction fees and yield farming.

- Governance Participation:

- Holders of SUSHI tokens can participate in the governance of the platform, voting on proposals that affect the platform’s future, such as new features, changes to protocol rules, and new liquidity pools.

- Staking and Yield Farming:

- Staking: Users can stake their SUSHI tokens to earn additional rewards, allowing them to generate passive income in the form of more SUSHI.

- Yield Farming: Liquidity providers can earn higher rewards through yield farming, where they stake their LP tokens in return for more SUSHI tokens.

- Decentralized Finance (DeFi) Participation:

- SushiSwap contributes to the broader DeFi ecosystem by providing decentralized trading options, enabling users to access decentralized financial products without needing to rely on centralized exchanges or institutions.

History of SushiSwap (SUSHI)

SushiSwap was launched in September 2020 by a pseudonymous developer known as Chef Nomi, along with two other co-founders, sushiswap and 0xMaki. The platform was a fork of Uniswap, meaning it started with a similar protocol but introduced new features and improvements to differentiate itself from the original.

- SushiSwap’s Forking of Uniswap: SushiSwap’s launch was somewhat controversial because it was a fork of Uniswap, with some features tweaked to offer additional benefits, such as governance via the SUSHI token and higher rewards for liquidity providers.

- SUSHI Token Launch: The SUSHI token had no premine, meaning no tokens were minted before the public launch, ensuring fairness and decentralization from the start. The SUSHI token was officially launched at Ethereum block number 10,750,000, with a zero supply at the time of launch.

- Platform Evolution: SushiSwap quickly gained traction within the DeFi space, attracting liquidity providers with its attractive reward system. Over time, it has continued to evolve, adding new features like Kashi (a lending and borrowing platform) and MISO (a launchpad for token issuance).

As of November 2023, SushiSwap has a circulating supply of around 231.87 million SUSHI tokens, with its ecosystem continuing to grow and diversify.

Risks of Using SushiSwap (SUSHI)

Like any decentralized exchange, there are several risks to consider when using SushiSwap:

- Transaction Fees:

- SushiSwap operates on the Ethereum network, which means users must pay gas fees for each transaction. These fees can be high during periods of network congestion, making smaller transactions costly.

- Smart Contract Risks:

- SushiSwap, like other DeFi platforms, relies on smart contracts to manage liquidity pools and execute trades. Bugs or vulnerabilities in the smart contracts could potentially be exploited by malicious actors, leading to the loss of funds.

- Impermanent Loss:

- Liquidity providers on SushiSwap face the risk of impermanent loss. This occurs when the value of the tokens in a liquidity pool changes relative to each other, resulting in a potential loss of value when withdrawing funds.

- “Rug Pulls” and Fraudulent Tokens:

- SushiSwap allows anyone to list tokens, meaning there is a risk of encountering fraudulent tokens or rug pulls—when developers create a token, list it on the exchange, and then abandon it after it accrues a significant amount of liquidity. Always exercise caution and perform due diligence before trading unfamiliar tokens.

Eyad –

‘

Harran –

DeFi good