About Pendle (PENDLE)

What is Pendle?

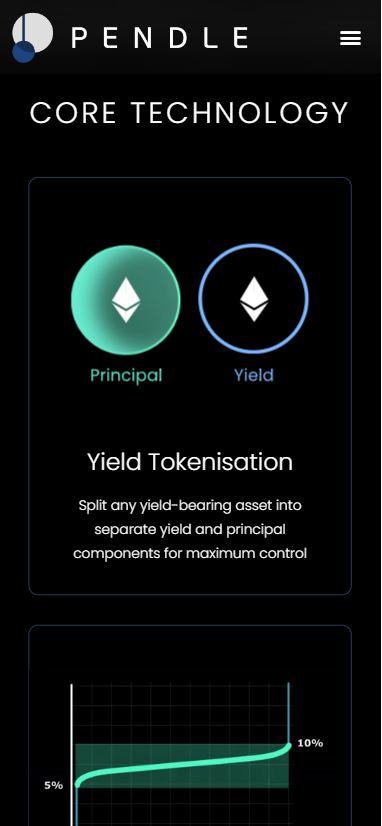

Pendle is a blockchain protocol that allows the tokenization and trading of future yield. It provides users with greater flexibility and control over the yield generated by their assets by separating the yield from the principal. This process is known as yield tokenization, where any yield-bearing asset (e.g., staking rewards, interest-bearing tokens, etc.) is split into two parts: the principal (the underlying asset) and the yield (the future earnings or rewards generated by that asset). Pendle’s goal is to offer users a platform for trading and utilizing future yield in ways that were not previously possible. The protocol is cross-chain compatible, meaning it can interact with multiple blockchain networks like Ethereum, Arbitrum, BNB Chain, and Optimism.

How Does Pendle Work?

Pendle works through a specialized Automated Market Maker (AMM) designed for yield trading. This AMM is unique because it supports assets with time decay, which sets Pendle apart from other DeFi protocols. Time decay refers to the diminishing value of the yield component as it approaches its maturity date, allowing users to buy or sell future yield at market prices.

Pendle’s AMM uses concentrated liquidity and employs a dual-fee structure to reduce concerns about impermanent loss for liquidity providers. Users of Pendle can also stake their $PENDLE tokens, participating in governance and earning rewards while engaging with the platform’s various features.

What Are the Potential Use Cases for Pendle?

Pendle’s ability to separate yield from principal opens up several use cases:

- Stability in Yield: Pendle allows users to manage volatile yield more effectively by enabling trading of future yield without a lock-up period.

- Yield Hedging: Users can hedge their yield exposure based on their risk preferences, helping them navigate market volatility.

- Long-Term Yield Exposure: Pendle gives users the option to go long on yield, allowing for greater flexibility in their investment strategies.

- Cross-Chain Utility: Since Pendle supports multiple blockchains, it offers the potential to bridge yield-bearing assets across different ecosystems, increasing its appeal to users of various networks.

Pendle’s cross-chain compatibility and its ability to tokenize yield makes it particularly attractive for decentralized finance (DeFi) users seeking advanced yield management tools.

What is the History of Pendle?

Although specific historical milestones are not outlined in the available information, Pendle has already established itself as a trusted project in the blockchain space. The protocol has undergone several security audits from well-known firms like Ackee Blockchain, Dedaub, and Dingbats, ensuring that Pendle operates with a high level of transparency and security.

Pendle’s native utility token, $PENDLE, plays a crucial role in the ecosystem, providing liquidity incentives, governance rights, and stakeholder rewards. As the protocol continues to grow, its unique approach to yield tokenization and trading is likely to attract more users and DeFi enthusiasts looking for new ways to manage and capitalize on their crypto assets.

Harran –

ecosystem