About Orion Protocol (ORN)

Orion Protocol (ORN) is a decentralized finance (DeFi) platform that aims to aggregate liquidity from both centralized and decentralized exchanges into one seamless platform. By providing real-time asset prices from multiple liquidity sources, Orion enables users to access the best trading opportunities while maintaining full control of their assets. The ORN token plays a central role in the ecosystem, offering various utilities including staking, discounted trading fees, and access to advanced features within the Orion Protocol.

What is Orion Protocol (ORN)?

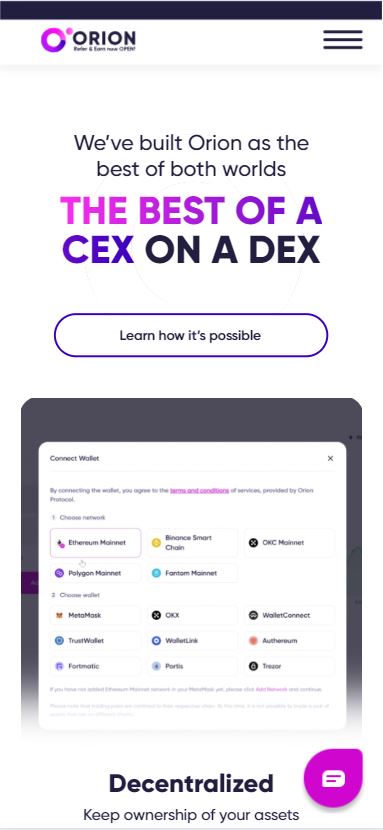

Orion Protocol is a decentralized platform designed to aggregate liquidity from both centralized exchanges (CEX) and decentralized exchanges (DEX) in one unified system. This integration allows traders to access the best possible asset prices across a variety of exchanges, providing a more efficient trading experience. Orion’s decentralized, non-custodial approach allows users to maintain full control over their assets, distinguishing it from traditional, centralized trading platforms.

By supporting over 200 digital assets, Orion Protocol aims to provide a versatile trading solution that caters to a wide range of cryptocurrency traders. The protocol aims to address the issue of liquidity fragmentation by consolidating multiple sources of liquidity into a single access point, allowing traders to get the best price for their trades in real time.

How Does Orion Protocol (ORN) Work?

Orion Protocol aggregates liquidity from both centralized exchanges (CEX) and decentralized exchanges (DEX) to offer users optimal asset prices in real time. This is achieved using a combination of the following technologies:

- Decentralized CEX Order Books: Orion uses decentralized order books to aggregate liquidity across centralized exchanges, enhancing price discovery and improving liquidity efficiency.

- AMM (Automated Market Maker) Price Curves: Orion integrates advanced AMM price curves, enabling efficient token swaps and more flexible trading options across different platforms.

- CEX Swaps: Orion uses complex centralized exchange (CEX) swaps to route trades through the most efficient paths, ensuring that users always get the best price available.

- Virtual Order Books: By providing a comprehensive view of available orders from both CEX and DEX platforms, Orion enables users to select the best trade route.

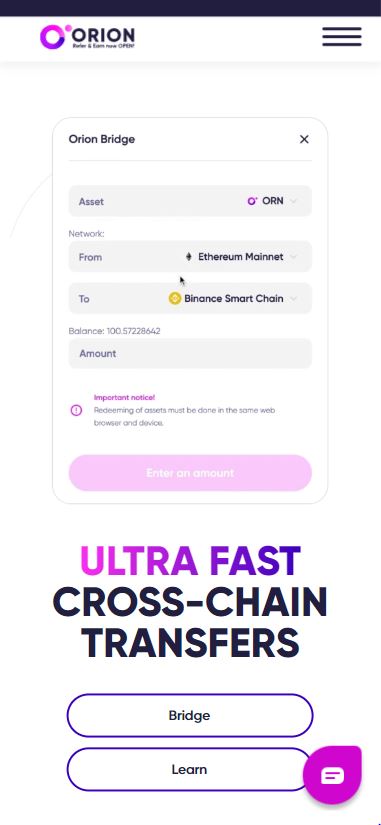

- Cross-Chain Bridge Integration: Orion integrates cross-chain bridges to allow trades between different blockchain ecosystems, further enhancing liquidity options.

The protocol’s price feeds update in real-time (milliseconds), ensuring that traders can make informed decisions based on the most up-to-date pricing information available.

What Are the Potential Use Cases for Orion Protocol (ORN)?

Orion Protocol addresses the issue of fragmented liquidity in the cryptocurrency market by providing a single access point for users to trade across multiple CEX and DEX platforms. Key use cases include:

- Optimized Trading: Users can access the most competitive prices for assets across multiple exchanges without the need to manually search different platforms.

- Cross-Chain Trading: Orion allows users to trade assets across different blockchains with the help of its cross-chain bridge integration.

- Liquidity Aggregation: Traders can benefit from Orion’s aggregated liquidity, allowing them to execute large trades without slippage.

- Atomic Swaps: Orion facilitates atomic swaps, which enable near-instant token transfers without the need for an intermediary, ensuring trustless and secure transactions.

- Staking and Fee Discounts: Orion Protocol’s ORN token can be staked for rewards and used to receive discounted trading fees on the platform, offering users an incentive to hold and use the token.

What is the History of Orion Protocol (ORN)?

Orion Protocol was founded in 2018 by Alexey Koloskov, a blockchain veteran with a deep background in both the cryptocurrency and traditional finance industries. Koloskov previously served as the Chief Architect and Creator of the Waves DEX. Before entering the cryptocurrency space, he created software solutions for major banks such as UniCredit and Deutsche Bank.

Recognizing the problem of fragmented liquidity in the cryptocurrency market, Koloskov launched Orion Protocol with the goal of addressing these inefficiencies. The platform officially launched its token, ORN, in July 2020, marking a significant milestone in its development. Since then, Orion Protocol has grown its ecosystem and improved its technology to provide a unified trading experience across both centralized and decentralized exchanges.

Key Highlights

- Token Name: ORN (Orion Protocol Token)

- Utility: Staking, discounted fees, governance, and advanced platform features.

- Goal: Aggregating liquidity from CEX and DEX platforms into a unified system.

- Technology: Decentralized CEX order books, AMM price curves, cross-chain bridges, and atomic swaps.

- Founded: 2018 by Alexey Koloskov.

- Token Launch: July 2020.

Orion Protocol aims to solve the liquidity fragmentation problem in the crypto market by providing a seamless, efficient, and decentralized trading experience. By offering a wide range of tools for traders, including optimized price discovery, staking opportunities, and cross-chain compatibility, Orion is positioning itself as a leader in the DeFi space.

Anthonywax –

Metaverse and crypto

Anthonywax –

Cryptocurrency market updates

Harran –

👍