About Kyber Network (KNC)

Kyber Network Crystal (KNC) is the native utility and governance token of the Kyber Network, an Ethereum-based decentralized liquidity protocol. The Kyber Network aims to streamline the process of swapping digital assets and cryptocurrencies across multiple decentralized applications (DApps), decentralized exchanges (DEXs), and other blockchain-based services. KNC token holders can also participate in governance by staking their tokens in the KyberDAO to vote on important proposals that shape the network’s future.

What is Kyber Network Crystal (KNC) v2?

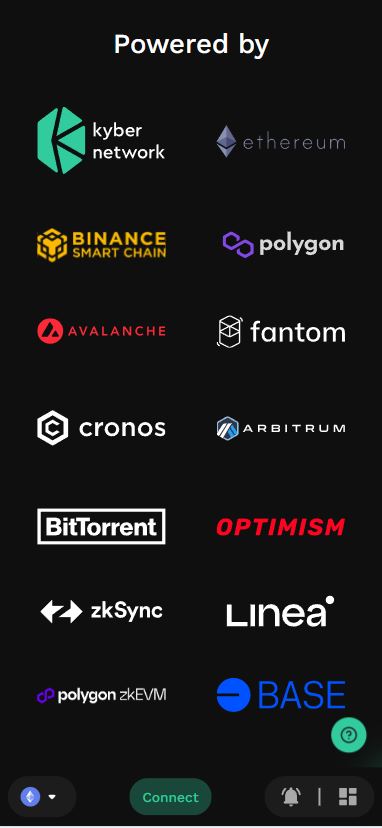

Kyber Network Crystal (KNC) v2 is an updated version of the original KNC token. It plays an integral role in the Kyber Network ecosystem, acting both as a utility token for transactions and a governance token for participation in network decisions. The Kyber Network is a multi-chain liquidity hub that aggregates liquidity from various sources to provide on-demand liquidity for DeFi DApps, DEXs, and other blockchain services. The primary goal is to ensure efficient asset swaps, while the KNC token enables holders to participate in governance through the KyberDAO.

How does Kyber Network Crystal (KNC) v2 work?

Kyber Network Crystal (KNC) v2 works within the Kyber Network, a decentralized liquidity protocol that sources liquidity from multiple DEXs to facilitate efficient and cost-effective swaps across DeFi applications. The network’s main platform, KyberSwap, offers token swap rates by aggregating liquidity from several decentralized exchanges, ensuring the best available price for users.

- KyberDAO and Governance: KNC token holders can stake their tokens in KyberDAO, a decentralized autonomous organization (DAO) that governs the Kyber Network. Stakers participate in the decision-making process, voting on proposals that influence the future direction of the protocol.

- Liquidity Aggregation: Kyber Network enables liquidity aggregation, pulling liquidity from different sources to offer competitive swap rates, making it highly efficient for traders and developers to access deep liquidity.

- On-Chain Transactions: All transactions on the KyberSwap platform are fully on-chain, meaning they are transparent and verifiable through Ethereum or any compatible blockchain explorer.

What are the potential use cases for Kyber Network Crystal (KNC) v2?

Kyber Network Crystal (KNC) has several key use cases within the broader DeFi ecosystem:

- Governance Participation: KNC token holders can participate in the governance of the Kyber Network through the KyberDAO, voting on important proposals that shape the protocol’s development and operations.

- Liquidity Aggregation: The Kyber Network aggregates liquidity from multiple sources, enabling developers to build DeFi applications with enhanced liquidity options. This can include features like token swaps, liquidity pools, and optimized trading strategies.

- Incentives for Liquidity Providers: KyberSwap incentivizes liquidity providers by rewarding them with tokens, including KNC, for their contributions to liquidity pools. These rewards help to improve liquidity and ensure competitive swap rates for users.

- Decentralized Trading: KyberSwap enables instant, decentralized token swaps without the need for a centralized third party, ensuring trustless, secure, and transparent transactions across various blockchains.

- DApp Development: Developers can leverage Kyber’s liquidity protocols to build new decentralized applications that require reliable liquidity, such as decentralized finance services, lending platforms, and prediction markets.

What is the history of Kyber Network Crystal (KNC) v2?

Kyber Network was developed in 2017 by Loi Luu, Victor Tran, and Yaron Velner with input from Vitalik Buterin, the co-founder of Ethereum, who served as an advisor. Kyber Network was built on the Ethereum blockchain to address issues of liquidity fragmentation within decentralized ecosystems, and KNC was introduced as a utility and governance token to connect various stakeholders, such as liquidity providers, traders, and developers.

Over the years, Kyber has evolved, launching the KyberSwap platform, a decentralized exchange (DEX) aggregator, and introducing new protocols designed to incentivize liquidity providers. Kyber has also worked on enhancing its liquidity aggregation strategies to provide users with more efficient and lower-cost token swaps.

The Kyber Network continues to improve its platform, with the launch of Kyber Network Crystal (KNC) v2, marking an important milestone for the network’s growth. As of now, Kyber Network has a total supply of 223.36 million KNC tokens, with a significant portion of these tokens already in circulation.

Harran –

👍