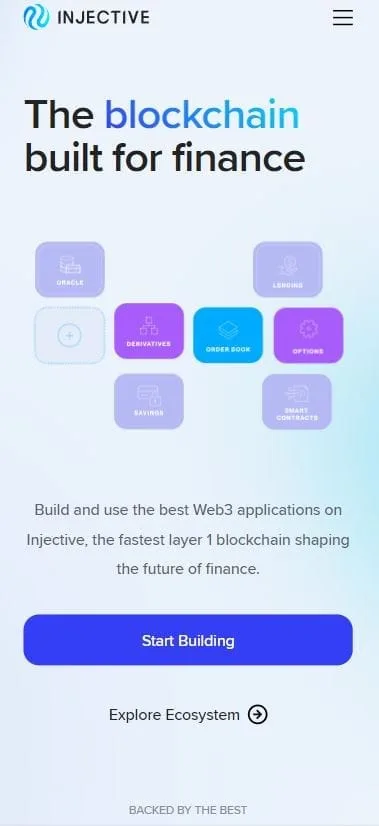

What is Injective?

Injective is a decentralized finance (DeFi) blockchain platform designed to provide high-performance, decentralized trading solutions. It is uniquely tailored for developers looking to build decentralized applications (dApps) in the financial sector, offering a set of robust modules for trading, cross-chain interoperability, and financial products. Injective is built on the Cosmos SDK and aims to offer decentralized, fast, and secure trading experiences through its advanced decentralized exchange (DEX) infrastructure.

Injective Protocol is primarily focused on decentralized financial markets, enabling users to trade, create, and access complex financial products without relying on centralized entities. With unique features like decentralized order books, cross-chain functionality, and an open-source ecosystem, Injective aims to disrupt traditional finance by offering permissionless, transparent, and scalable financial tools.

How Does Injective Work?

The Injective Protocol operates through several key components:

1. Injective Chain:

- The core of the Injective platform is its decentralized exchange (DEX) built on the Cosmos network. This chain allows users to trade spot and derivatives markets using Ethereum and Cosmos-native assets, all while ensuring high performance and scalability.

- Injective’s blockchain enables developers to create decentralized financial markets with reduced latency and costs, leveraging familiar Ethereum development kits like Solidity and Vyper.

2. Key Modules:

- Auction: A mechanism where token holders can bid on baskets of tokens accumulated from exchange fees. The highest bid is paid in INJ tokens, which are then burned to reduce the circulating supply.

- Exchange: Manages the core exchange features, such as order book management, trade execution, order matching, and settlement. It supports a range of financial instruments including spot markets, futures, and derivatives.

- Insurance: Allows underwriters to back derivative markets hosted on Injective, providing insurance to users and improving market liquidity.

- Oracle: Ensures that external real-world price data (e.g., stock prices or commodity data) is fed into the Injective ecosystem to set the correct prices for trading assets.

- Peggy: A cross-chain bridge that connects the Injective protocol with the Ethereum blockchain, allowing ERC-20 tokens to be converted into Cosmos-native assets. This feature expands the liquidity and asset availability across Injective’s ecosystem.

3. Cosmos SDK and Tendermint:

- Injective is built on the Cosmos SDK, a modular framework designed to create customized blockchains. This enables Injective to achieve seamless interoperability with other Cosmos-based blockchains as well as Ethereum.

- The Tendermint consensus algorithm ensures that transactions on Injective are fast and final, reducing the risks associated with delays and forks common in other blockchain platforms.

Who Created Injective?

Injective was co-founded by Eric Chen and Albert Chin.

- Eric Chen has a background in finance, earning a degree in Finance from NYU’s Stern School of Business. He also worked as a Venture Partner at Innovating Capital, an early investor in Injective Protocol.

- Albert Chin is a former Software Development Engineer at Amazon, holding a Master’s degree in Computer Science from Stanford University.

Injective has attracted notable investors, including Pantera Capital, Mark Cuban, and several others who have helped the project raise tens of millions of dollars. This backing has allowed the team to develop a powerful decentralized finance platform with a focus on scaling, interoperability, and ease of use for developers.

Why Use Injective?

Injective aims to provide a comprehensive solution for decentralized finance (DeFi) with a variety of use cases:

- Decentralized Trading: Injective enables the creation of decentralized exchanges with customizable features. It eliminates the need for centralized intermediaries, giving users full control over their assets and trades.

- Access to Financial Products: The platform provides access to a broad range of financial instruments, including spot markets, derivatives, and synthetic assets, allowing users to trade a variety of assets from different blockchains.

- High-Speed and Low-Cost Transactions: Injective’s blockchain enables faster and cheaper transactions than many traditional Layer 1 blockchains, making it ideal for high-frequency trading (HFT) and other time-sensitive financial operations.

- Cross-Chain Trading: Injective’s cross-chain capabilities allow users to trade assets from different blockchains (like Ethereum and Solana) in a seamless manner, improving liquidity and asset diversity on the platform.

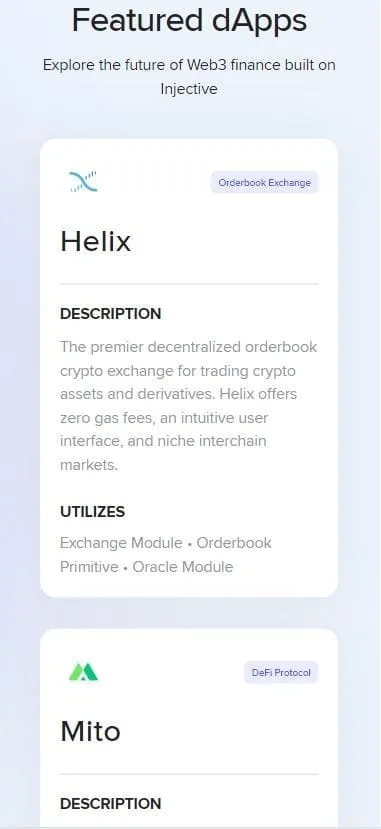

- Comprehensive DeFi Ecosystem: Developers can build a wide variety of decentralized financial applications on Injective, ranging from exchanges, insurance products, lending protocols, to prediction markets, creating an expansive ecosystem of tools for DeFi users.

Anthonywax –

Cryptocurrency security updates