What is Compound? (COMP)

The Beginner’s Guide

Compound is a decentralized finance (DeFi) protocol that operates on the Ethereum blockchain. It enables users to lend and borrow cryptocurrencies without the need for a traditional financial intermediary, like a bank. The platform uses smart contracts to create a decentralized money market, where lenders earn interest by depositing assets, and borrowers can access liquidity by collateralizing their own crypto assets.

In simpler terms, Compound allows users to earn interest on their cryptocurrency holdings by lending them to others, while borrowers can take out loans by posting cryptocurrency as collateral. All of this is powered by smart contracts, which ensure that transactions are automated and trustless.

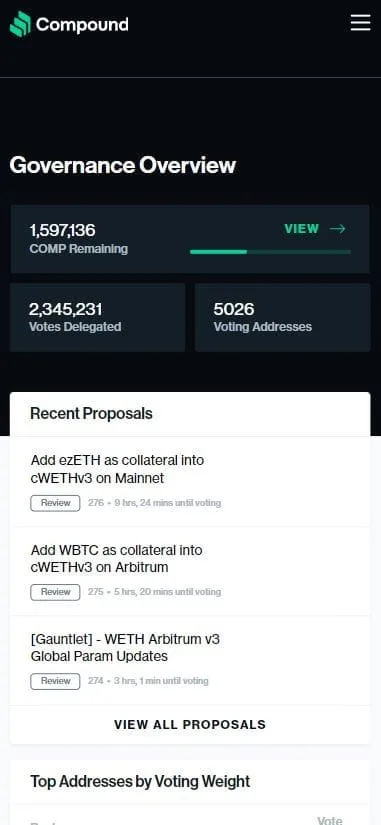

The Compound protocol uses a native cryptocurrency called COMP, which plays a key role in the ecosystem. COMP tokens are awarded to users who interact with the protocol (e.g., lending, borrowing, or repaying loans). These tokens are used as incentives to encourage participation and governance of the Compound network.

How Compound Works

- Lending and Earning Interest:

- Lenders deposit their cryptocurrency into lending pools on the Compound platform. When a deposit is made, the lender receives a new token called a cToken (e.g., cETH, cDAI, cBAT) that represents the asset they’ve deposited.

- cTokens can be traded or transferred freely, but they are only redeemable for the original cryptocurrency when the user withdraws their deposit. The amount of cTokens a user has reflects the amount of their deposit and the interest they have earned.

- The interest rates on Compound are algorithmically set and adjust based on the supply and demand for different assets. When there is a high supply of a particular asset, interest rates fall; when there’s a high demand, rates rise. This incentivizes lenders to provide liquidity to the most in-demand assets at any given time.

- Borrowing and Collateral:

- Borrowers post cryptocurrency as collateral to borrow other assets from the Compound protocol. The collateral required is typically a higher value than the amount borrowed (e.g., a borrower may need to post $150 worth of crypto to borrow $100 worth of another asset).

- The borrowing capacity is determined by a collateralization ratio, which ensures that borrowers don’t take out more than they can repay. The protocol automatically adjusts the borrower’s loan-to-value ratio based on the collateral they’ve provided.

- If the value of the collateral drops (due to market fluctuations), borrowers may face liquidation if their collateral falls below the required threshold. This process helps maintain the solvency of the system.

- Compound’s Governance and Incentives:

- To encourage user engagement, COMP tokens are distributed to both lenders and borrowers in the Compound ecosystem. The amount of COMP tokens awarded is based on the amount of cTokens held by users, incentivizing long-term participation.

- COMP tokens are also used for governance within the Compound protocol. Holders of COMP tokens can propose and vote on changes to the system, such as adjusting interest rate models or adding new assets to the platform. This governance structure ensures that the protocol is decentralized and driven by the community.

- Smart Contracts and Automation:

- Compound’s entire lending and borrowing process is automated through smart contracts that run on the Ethereum blockchain. These contracts execute transactions without the need for intermediaries, ensuring that the process is transparent, secure, and efficient.

- Interest payments, collateral management, and liquidations are all handled by smart contracts, allowing the system to operate in a trustless and automated manner.

Who created Compound?

Compound was founded by Robert Leshner and Geoffrey Hayes. Robert Leshner is a serial entrepreneur with a background in economics and technology, while Geoffrey Hayes has experience in engineering and product management. Before launching Compound, the two worked together on a company called Britches, which aggregated inventory from local stores to be sold through Postmates.

Compound was launched in 2018, and it quickly became one of the leading platforms in the DeFi space. In its early days, Compound raised $8.2 million in funding from prominent venture capital firms, including Andreessen Horowitz and Bain Capital Ventures. In 2019, it raised an additional $25 million, further solidifying its position in the DeFi ecosystem.

Mischiefismm –

Comp dead? What’s wrong???

Steven Broken –

Ok, so great