About DIA (DIA)

What Is DIA (DIA)?

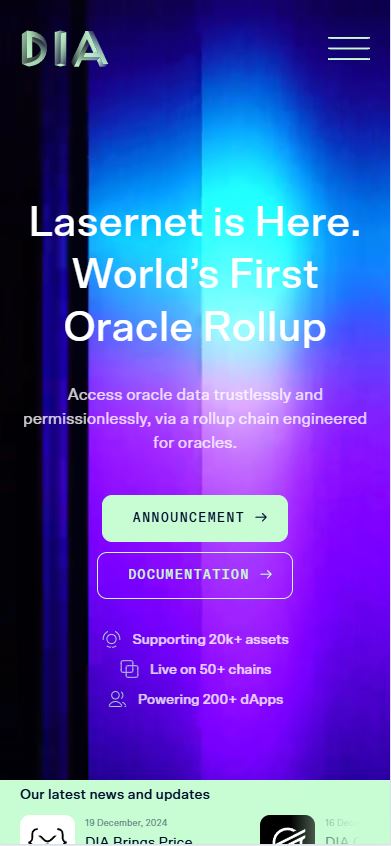

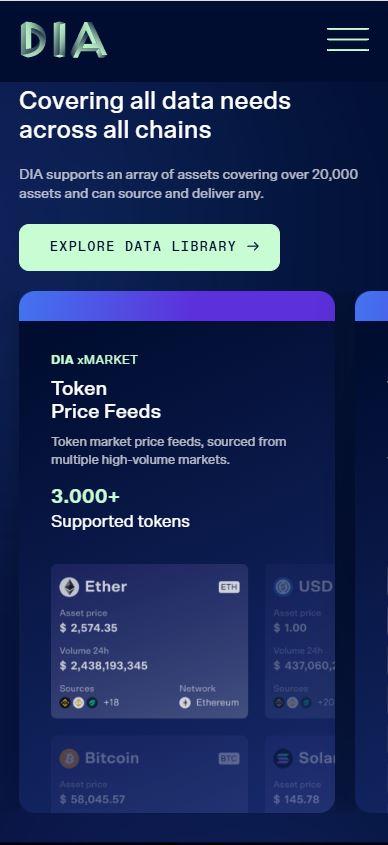

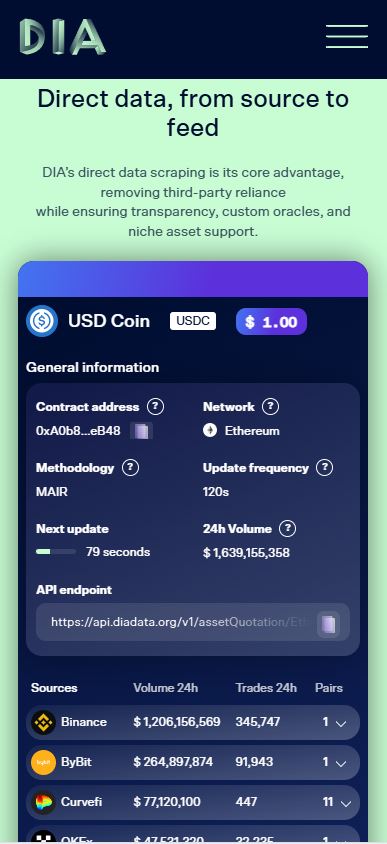

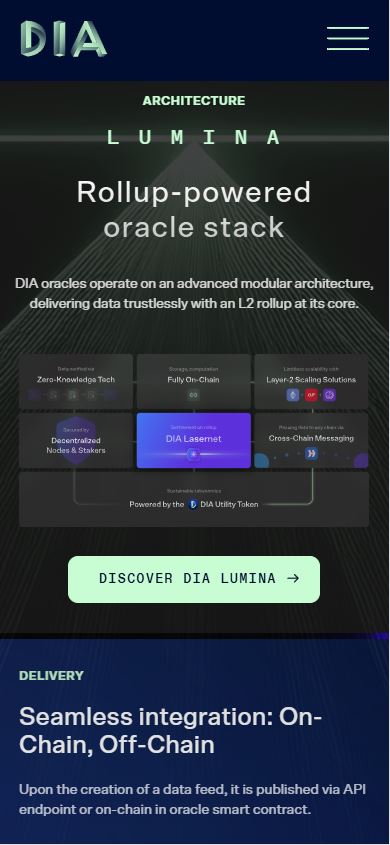

DIA (Decentralised Information Asset) is an open-source oracle platform designed to enable market actors—such as data providers, analysts, and users—to source, supply, and share reliable and verified data. DIA aims to create an ecosystem for open financial data within a financial smart contract ecosystem, bridging the gap between off-chain data from multiple sources and on-chain smart contracts. This is essential for building a wide range of decentralized finance (DeFi) applications (dApps), as smart contracts require accurate and trustworthy external data to execute properly.

The platform leverages decentralized governance and financial incentives to ensure the continuous flow of verified data. DIA’s open-source nature allows transparency in the data provision process and is geared towards the decentralized finance sector. The governance of the platform is managed through the DIA token, which is based on the ERC-20 Ethereum protocol.

The DIA platform was launched in 2018, with the DIA token becoming available to the public during a bonding curve sale held from August 3 to August 17, 2020. During this sale, 10.2 million DIA tokens were sold.

Who Are the Founders of DIA?

DIA was co-founded by a group of a dozen individuals, with Paul Claudius, Michael Weber, and Samuel Brack leading the project.

- Paul Claudius serves as the lead advocate and often acts as the Chief Business Officer (CBO) of DIA. He holds a master’s degree in international management from ESCP Europe and a bachelor’s in business and economics from Passau University. Before his work with DIA, Claudius co-founded BlockState AG and c ventures and was the director at a nutrition company called nu3.

- Michael Weber, the Founder and Association President of DIA, has a background in management, economics, and physics, with degrees from ESCP Business School and the University of Cologne. He has worked with numerous banks and financial institutions before venturing into the crypto space, where he founded several projects, including Goodcoin, myLucy, and BlockState.

- Samuel Brack is the Chief Technology Officer (CTO) of DIA. Like Claudius and Weber, Brack is involved with BlockState. He holds a master’s degree in computer science from Humboldt University of Berlin and is pursuing his PhD as of 2020.

What Makes DIA Unique?

DIA aims to become the “Wikipedia of financial data” by addressing the problems that currently plague financial data in the crypto and DeFi space—such as outdated, unverifiable, and hard-to-access data. It seeks to solve these issues by creating a system where financial incentives drive the continuous supply of open-source, validated data streams to its oracles.

DIA’s oracles are designed to be more transparent and scalable compared to traditional solutions. The platform argues that current oracle models are vulnerable to manipulation, hard to scale, and lack transparency, which limits their effectiveness in the rapidly evolving crypto and DeFi sectors. By incentivizing users to contribute data and ensuring the accuracy of the information provided, DIA aims to enhance the reliability and usability of decentralized financial applications.

The DIA governance token (DIA) is used for multiple purposes within the platform:

- Funding the collection and validation of data

- Voting on governance decisions related to the platform’s development

- Incentivizing platform growth and development

Additionally, users can stake DIA tokens to promote the appearance of new data on the platform. However, access to historical data on DIA is free, making it accessible for anyone who needs it.

How Many DIA (DIA) Tokens Are There in Circulation?

The total supply of DIA tokens is capped at 200 million coins. Here’s a breakdown of how the tokens are allocated:

- 10 million tokens were initially sold in a private sale.

- 19.5 million tokens are allocated to early investors and advisors, with Outlier Ventures being the largest investor.

- 30 million tokens were offered during the bonding curve sale in August 2020, of which 10.2 million were sold to the public. The remaining 19.8 million tokens were burned.

- 24 million tokens are reserved for the project’s founders and team, with a vesting period of 29 months.

- 25 million tokens are locked for future use to further develop the DIA ecosystem.

- 91.5 million tokens are kept in the company’s reserve and will be unlocked gradually over 10 years, with equal releases every December. After the first release, half of these tokens were immediately burned following a community vote.

In addition to these mechanisms, DIA employs a “proof-of-use” and “proof-of-truth” model, where smart contracts using DIA oracles receive DIA tokens on a daily basis. This encourages the use of DIA’s oracles and ensures the validity of the data it provides.

Conclusion

DIA is positioned as a key player in the DeFi space by addressing critical data challenges through its open-source oracle platform. By ensuring a transparent and scalable data provision system, DIA seeks to enhance the reliability of decentralized financial applications. Its governance token (DIA) plays a pivotal role in funding the platform’s operations, incentivizing data collection, and enabling community-driven decisions. With a limited token supply and a unique incentive structure, DIA aims to reshape how financial data is shared and utilized in the blockchain ecosystem.

Harran –

specific APIs