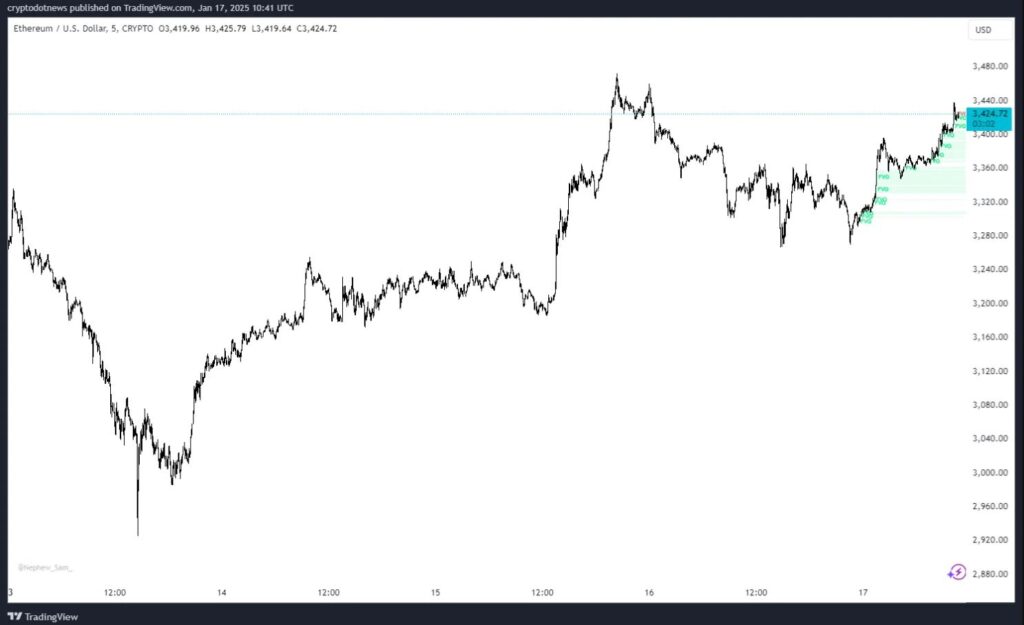

Ethereum has seen a significant upswing, breaking through the $3,400 resistance mark and reaching a current trading price of $3,406.72. This surge follows a week of price struggles from January 11 to 17, during which Ethereum had been trapped in a downward trend. However, the cryptocurrency has broken free, with a notable climb in the past few days, fueled by growing optimism surrounding political shifts in the U.S. ahead of President-elect Donald Trump’s inauguration on January 20.

The renewed market optimism comes amidst speculation that Trump’s incoming administration might take a more crypto-friendly approach, including the signing of an executive order on cryptocurrencies. There are reports that the executive order could direct all federal agencies to review their policies on cryptocurrency, potentially easing regulations and bringing more clarity to the industry. Additionally, rumors suggest the order could include provisions to suspend ongoing litigation against major crypto industry players, which has raised hopes for a more favorable regulatory environment.

Positive Market Reactions from SEC Settlement and Political Developments

The excitement surrounding Trump’s potential crypto-friendly moves was further fueled by a recent action by the U.S. Securities and Exchange Commission (SEC). The SEC reached a settlement with crypto company Abra over unregistered crypto lending products, signaling a more collaborative approach to regulating the crypto space. This settlement is seen as a positive step forward for the broader market, and its timing coincided with the broader upswing in the crypto market, which saw a 3.54% increase in the last 24 hours, according to CoinMarketCap.

Adding to the optimism, the election of Congressman Tom Emmer as Vice Chair of the Digital Assets Subcommittee on January 15 has strengthened expectations that the new administration will pursue policies that are more favorable to the cryptocurrency industry. Emmer has been a vocal advocate for pro-crypto legislation, and his new role is likely to be a catalyst for further positive developments in the space.

Ethereum’s Pectra Upgrade and Long-Term Investor Sentiment

In addition to political developments, Ethereum’s price rally is also supported by technical advancements within the Ethereum network. One of the most anticipated upgrades is the upcoming Pectra Upgrade, which was highlighted during Ethereum’s Execution Layer Meeting 203. The Pectra upgrade is expected to address some of the long-standing issues that have plagued the Ethereum network, such as congestion and high gas fees.

The Pectra upgrade is designed to enhance the Ethereum network’s consensus layer, improving transaction speed and efficiency. More importantly, it will lay the foundation for better interoperability between Layer 2 solutions and the Ethereum mainnet, an essential feature for the future growth and scalability of blockchain technologies. These improvements are seen as critical for Ethereum’s continued dominance in the smart contract and decentralized application space.

Technical Indicators Signal Further Upside Potential

From a technical analysis perspective, Ethereum is showing signs of continued upward momentum. According to the Moving Average Convergence Divergence (MACD) chart, ETH is presenting buy signals, suggesting that the price could continue to rise in the near term. The MACD is a momentum indicator that tracks changes in market trends, and when it signals a positive shift, it often precedes further price increases.

Additionally, the HODL Waves chart, which tracks long-term investor behavior, shows a high number of ETH tokens being held for more than twelve months. This long-term holding trend is a bullish signal, as it reflects confidence in Ethereum’s future and reduced selling pressure in the short term. With strong support from long-term holders and positive technical indicators, Ethereum seems well-positioned for further price gains.

Outlook: Minor Fluctuations Ahead, But Bulls Are in Control

While Ethereum’s price may experience some short-term fluctuations as the market digests the ongoing political and technological developments, the overall outlook remains positive. The combination of potential regulatory clarity from the U.S. government, the Ethereum network’s upcoming upgrades, and strong long-term investor sentiment suggests that ETH could see further price increases in the coming weeks and months.

In summary, Ethereum’s recent breakout above the $3,400 mark is being driven by a confluence of factors: political expectations, regulatory developments, and technical advancements. If these trends continue, Ethereum’s rally could be poised for further gains, making it one of the most promising cryptocurrencies to watch in the near future. However, investors should remain cautious of potential volatility as the market responds to these unfolding developments.