The price of EOS surged by 25%, reaching $0.61, following the announcement that the network would be rebranding as Vaulta and shifting its focus toward web3 banking. This rebrand aims to position Vaulta as an operating system for decentralized financial services, part of a broader vision to integrate blockchain technology with traditional finance. The transition includes a token swap and is expected to be completed by the end of May 2025, though the timeline may change.

Yves La Rose, the founder and CEO of the Vaulta Foundation, emphasized that the rebrand is more than just a name change, describing Vaulta as the culmination of years of planning and strategic development. The goal of Vaulta is to provide scalable, decentralized financial services that can bridge the gap between blockchain and traditional banking systems. As part of the transition, Vaulta will introduce the Vaulta Banking Advisory Council, consisting of banking experts who will help guide the project toward its web3 banking ambitions.

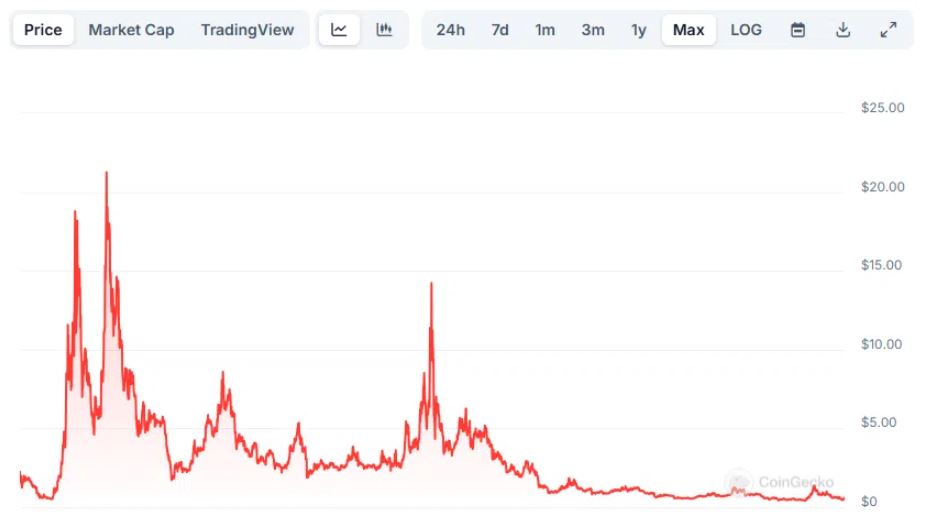

The rebrand comes after a period of weak price performance for EOS, which has struggled to recover from its all-time high in 2018 and has remained significantly lower than its 2021 levels. The new direction toward web3 banking and decentralized finance is seen as a major pivot to revitalize the project.

Additionally, the blockchain security firm SlowMist issued a warning about address poisoning attacks targeting EOS holders. In these attacks, bad actors send out small amounts of EOS (0.001 EOS) to lure users into interacting with fraudulent addresses that resemble legitimate ones. This could potentially lead to users making mistaken transactions with attackers’ addresses.

As part of the rebrand, Vaulta will also integrate with exSat, a Bitcoin digital banking solution, positioning BTC as a key part of Vaulta’s financial ecosystem. Vaulta’s upcoming announcements will include a new token ticker and additional partnerships, which are expected to further define its role in the decentralized financial space.

The rebrand to Vaulta represents a significant shift for EOS, signaling its ambition to become a player in the emerging field of web3 banking. The positive market response to the news suggests that investors are optimistic about the new direction, but more details about Vaulta’s integration with traditional finance and its broader ecosystem will be closely watched in the coming months.

L’audace à fini par payé

Good