A recent survey conducted by crypto exchange CEX.IO, citing data from Allium, has revealed that automated trading bots were responsible for a staggering 70% of stablecoin transaction volume in 2024. The analysis, which examined blockchain activity across Ethereum, Base, and Solana, highlights the significant role of bot-driven activity in the stablecoin ecosystem. Notably, Base, Coinbase’s layer-2 network, surpassed Ethereum in raw transaction volume due to the overwhelming influence of bots.

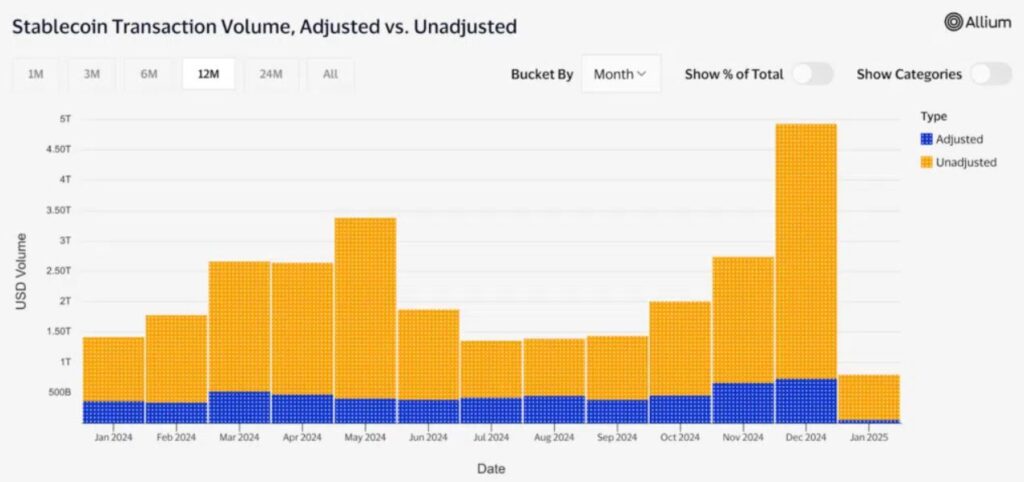

According to the survey, 77% of the total stablecoin transaction volume in 2024 fell into the “unadjusted” category, which primarily consists of bot-driven transactions. This represents a significant increase compared to 2023, when bot activity accounted for 80% of the unadjusted category. By 2024, this figure had risen to 90%, leading CEX.IO to conclude that 70% of all stablecoin transaction volume last year was attributable to bot transfers.

USDC, the stablecoin issued by Circle, dominated the unadjusted category, making up over 65% of the volume. This underscores the fact that a substantial portion of USDC’s transaction activity was driven by bots. Networks like Solana and Base, where USDC supply is predominant, saw unadjusted transactions represent over 98% of stablecoin activity as of December 2024. The report highlights that Base, in particular, benefited from bot activity, enabling it to surpass Ethereum in total stablecoin transaction volume during the fourth quarter of 2024.

The survey also emphasized that the stablecoin transaction landscape would look entirely different without the influence of bots. While adjusted stablecoin transfer volume—representing organic, human-driven transactions—doubled in 2024, it still lagged behind the exponential growth of bot-driven activity. Tether (USDT) remained the dominant stablecoin for organic transactions, accounting for over 68% of adjusted volume. Meanwhile, PayPal’s stablecoin, PYUSD, showed the highest adoption growth, tripling its share in adjusted transactions. However, it still represented less than 2% of organic transaction activity, indicating its relatively small but growing presence in the market.

The findings shed light on the evolving dynamics of the stablecoin market, where automated trading bots play a pivotal role in driving transaction volume. While this trend highlights the efficiency and scalability of blockchain networks like Base and Solana, it also raises questions about the true nature of stablecoin adoption and usage. As bot activity continues to grow, the distinction between organic and automated transactions becomes increasingly important for understanding the health and sustainability of the stablecoin ecosystem.

In conclusion, the survey reveals a stablecoin market heavily influenced by automated trading, with bots accounting for the majority of transaction volume in 2024. While networks like Base and Solana have benefited from this trend, the dominance of bot activity underscores the need for a deeper analysis of organic adoption and usage patterns. As the stablecoin landscape continues to evolve, understanding the interplay between human and automated transactions will be crucial for stakeholders and investors alike.

wow