On Friday, the cryptocurrency market staged a remarkable rally that stood in stark contrast to the ongoing decline in U.S. equities, which extended their losing streak. Bitcoin surged to a one-month high, gaining 5.5% in just 24 hours.

As the crypto market gained momentum, Solana experienced a significant rise of 8%, crossing the $170 mark for the first time since early June. Analysts noted the resilience of decentralized blockchains, particularly as a widespread IT outage was linked to a malfunctioning software update that disrupted systems globally.

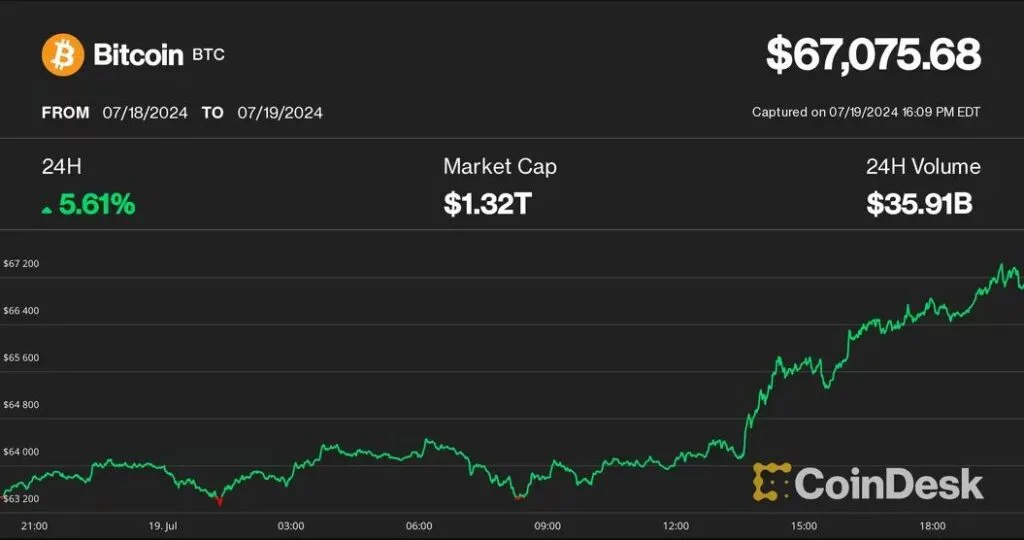

The rally kicked off with Bitcoin (BTC) rising from $64,000 during the early U.S. trading session, eventually breaking through the $67,000 threshold for the first time since June 17. This price surge was supported by robust trading volumes associated with BlackRock’s spot Bitcoin ETF (IBIT). At the time of reporting, Bitcoin was trading just above $67,000, marking a 5.5% increase over the past 24 hours.

Among the major altcoins, Solana (SOL) led the charge with an impressive 8.5% gain, reaching over $170 for the first time since June. This performance outpaced the broader digital asset benchmark, the CoinDesk 20 Index (CD20), which rose by 4.3%.

Ethereum’s ether (ETH) managed to reclaim the $3,500 level, though it lagged behind with a more modest 3% increase. Regulatory filings from Cboe indicated that the first spot-based ETH exchange-traded funds (ETFs) in the U.S. are set to begin trading on Tuesday next week.

Earlier this week, cryptocurrencies experienced a downward trend alongside a sell-off in U.S. stocks. However, the rally observed on Friday occurred even as major equity indexes continued their losing streak.

As of 1 p.m. ET, the tech-heavy Nasdaq Composite was down by 0.8%, and the broader S&P 500 had dropped by 0.6%. Meanwhile, gold prices fell over 2% during the day after reaching a new all-time high earlier this week.

This market activity coincided with significant disruptions caused by a software update from cybersecurity firm CrowdStrike, which resulted in widespread computer outages affecting airlines, banks, and various businesses. In light of these events, some crypto analysts highlighted the resilience of decentralized systems, such as public blockchains, when compared to centralized networks.

Charles Edwards, the founder of crypto hedge fund Capriole Investments, remarked on Bitcoin’s sudden price surge that aligned with the opening of U.S. traditional markets, suggesting it might indicate renewed interest from institutional investors. He tweeted, “Did some institution just wake up and decide Bitcoin is a safe haven decentralized store of value as global tech and banking systems fail from Microsoft’s blue screen of death?”

Looking ahead, Bitcoin is currently trading within a multi-month sideways channel, oscillating between $56,000 and $73,000. Although spot prices may remain range-bound in the near term, traders are increasingly preparing for a potential breakout toward new all-time highs as the U.S. elections approach in November. Digital asset hedge fund QCP noted strong demand for December $100,000 Bitcoin call options from institutional players.

Mads Eberhardt, a crypto analyst at Steno Research, maintained a bullish outlook for the second half of the year, citing multiple favorable factors such as anticipated U.S. interest rate cuts, increasing liquidity, regulatory clarity in Europe, and the possibility of more crypto-friendly leadership in the U.S. “Bitcoin at $100,000. Ethereum at $6,500,” he stated, outlining his price targets.

Mainant c’est plus de 100,000 $

Now it is beyond 100K

Bitcoin tops 97$