There is growing optimism among crypto options traders that Bitcoin (BTC) will reach new highs by the end of November, fueled by macroeconomic factors and the upcoming U.S. presidential election.

Options data shows a clear market focus around certain strike prices for Bitcoin. According to Bloomberg, options with expiration dates around November 8 have their highest open interest at the $75,000 strike price, signaling that this level could be a key market focus. Additionally, call options expiring on November 29 have significant open interest at the $80,000 strike price, with further concentrations at $70,000 and even $100,000 for December expirations.

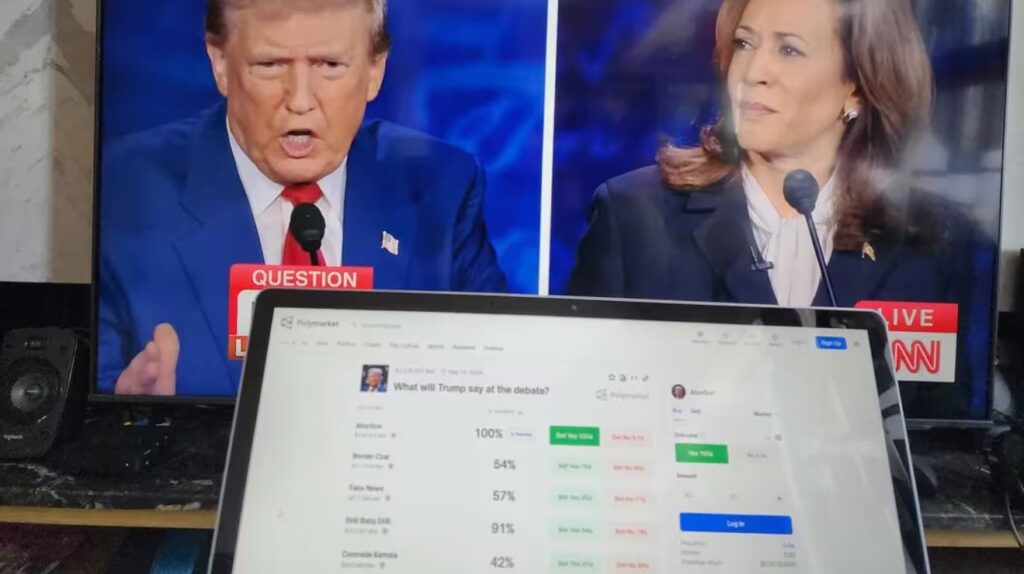

While there are expectations that a Republican win, particularly Donald Trump, could act as a bullish catalyst for Bitcoin due to his pro-crypto stance, many traders are now suggesting that the asset is poised to rise regardless of the election outcome. Both presidential candidates, Trump and Kamala Harris, have signaled pro-crypto positions, with Trump emphasizing policies to strengthen the U.S. as a Bitcoin powerhouse, and Harris focusing more on regulatory protection.

Jeff Mei, COO of crypto exchange BTSE, noted that while it’s hard to predict whether the candidates’ promises will materialize, the market is responding positively to the potential policy shifts regardless of who wins. He added that the U.S. Federal Reserve’s likely rate cuts, along with recent gains in the stock market, support the view that Bitcoin could surpass its previous all-time highs, possibly reaching $80,000.

In fact, the rise in Bitcoin’s implied volatility around election time suggests traders are positioning for potential price moves. However, some analysts caution that the increased options activity, particularly in the $80,000 calls, could be more of a market hedge than a direct bet on a significant rally. Augustine Fan, head of insights at SOFA, described these positions as “cheap options” against a broader market rally, with a bias towards higher prices after the election, but not necessarily indicating an outright bullish outlook.

Overall, Bitcoin’s price behavior in the lead-up to the U.S. elections is being seen by many as a hedge, with options traders placing bets on potential upside, while macroeconomic factors like the Fed’s rate cuts and the broader market environment remain key drivers for the asset’s outlook.

Even beyond that