About Pyth Network (PYTH)

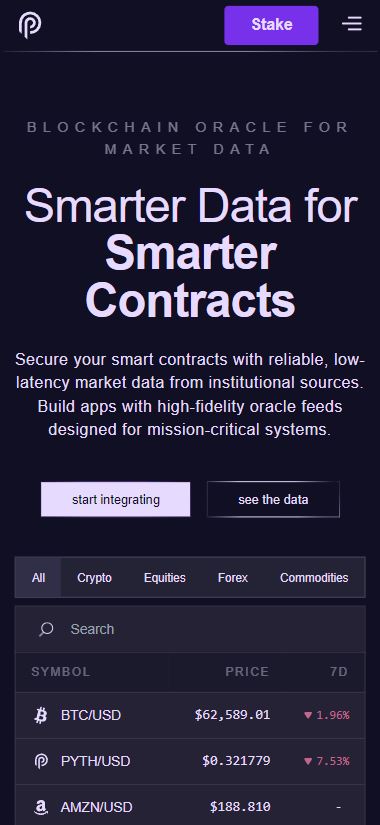

The Pyth Network (PYTH) is a cutting-edge, first-party oracle network designed to provide real-time, high-quality financial data to decentralized applications (dApps) across more than 40 blockchains. With over 380 low-latency price feeds, Pyth delivers data across multiple asset classes, including cryptocurrencies, equities, foreign exchange (FX) pairs, commodities, and exchange-traded funds (ETFs). The network aggregates market data directly from major financial institutions like Binance, OKX, Jane Street, and Cboe Global Markets, among others, ensuring that the data used by smart contracts is both reliable and up-to-date.

Pyth’s innovative oracle system has rapidly grown, securing over $1 billion in total value and supporting over $100 billion in trading volume. It has become a key player in the decentralized finance (DeFi) space, with integration into more than 250 applications. The protocol allows developers to seamlessly access real-time price data, enhancing the reliability and functionality of DeFi platforms.

What is Pyth Network (PYTH)?

Launched in 2021, Pyth Network is a trailblazer in bridging the traditional financial world with blockchain technology. Its core mission is to supply decentralized applications with real-time, accurate, and high-fidelity market data, thereby enhancing the performance and reliability of smart contracts across a range of financial sectors. By acting as a first-party oracle network, Pyth directly sources its data from a consortium of prominent financial market players, including exchanges, market makers, and financial services providers. This direct data sourcing helps mitigate common problems like data manipulation and inaccuracies seen in other oracle networks, ensuring the integrity of the data used in smart contracts.

Pyth offers more than 380 price feeds that cover a diverse array of financial assets, such as:

- Cryptocurrencies

- Equities (stocks)

- ETFs

- Foreign exchange (FX) pairs

- Commodities

This extensive range makes Pyth suitable for a variety of DeFi applications, such as decentralized trading platforms, lending protocols, and other financial services that require accurate, real-time data.

How Does Pyth Network (PYTH) Work?

At its core, Pyth Network operates as a decentralized first-party oracle, meaning it pulls data directly from a wide network of trusted market participants. These include global exchanges, market makers, and liquidity providers who contribute price data in real-time. This setup ensures that the data fed into smart contracts is accurate, reliable, and resistant to manipulation.

The network’s low-latency price feeds ensure that dApps can access up-to-the-minute market data, supporting critical financial operations like:

- Real-time trading

- Lending and borrowing protocols

- Asset price tracking

- Risk management

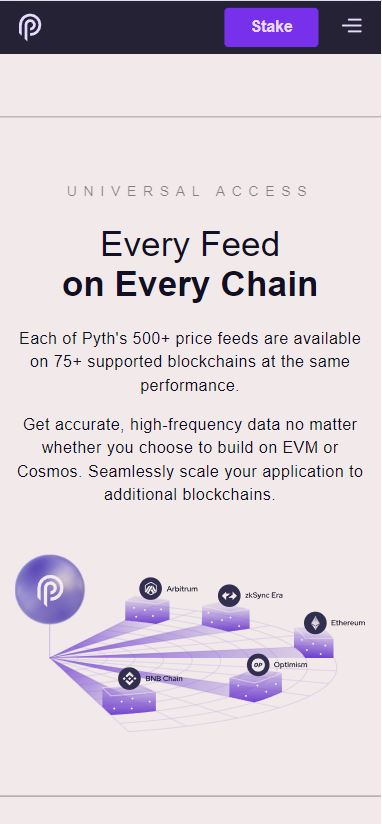

In addition to its primary data feeds, Pyth offers a cross-chain pull oracle system that allows applications to “pull” the latest price data directly onto their blockchain when needed. This gives developers the flexibility to integrate accurate price data seamlessly into their platforms, without requiring explicit permission or approval.

Pyth’s data aggregation system continuously verifies and validates the market data it sources, helping guard against inaccuracies and ensuring that the price feeds are trustworthy. This design makes Pyth a robust and secure oracle solution for a wide range of financial applications.

Key Features and Capabilities

- Real-Time Data: Pyth provides up-to-date market prices from major financial institutions, reducing latency and ensuring accuracy.

- Wide Coverage: With over 380 price feeds, the network supports a diverse range of assets, including cryptocurrencies, traditional financial markets, and commodities.

- First-Party Oracle: Pyth sources its data directly from trusted financial entities, eliminating the risks associated with third-party intermediaries.

- Cross-Chain Compatibility: Pyth can deliver data across 40+ blockchains, making it accessible to a wide variety of decentralized applications.

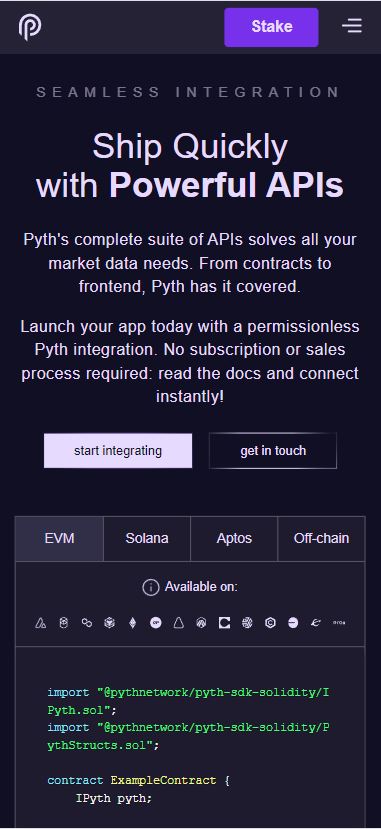

- Developer-Friendly: The Pyth Network offers open-source code repositories and integration tools to help developers quickly build and deploy applications.

- Permissionless Integration: Any decentralized application can integrate with Pyth’s price feeds without needing explicit approval or authorization.

Potential Use Cases for Pyth Network (PYTH)

The real-time, high-fidelity data provided by Pyth makes it suitable for numerous applications, particularly in the DeFi ecosystem:

- Decentralized Exchanges (DEXs): Real-time price feeds are essential for executing trades at accurate market prices.

- Lending and Borrowing Platforms: Accurate price data ensures fair collateral valuation and loan-to-value ratios.

- Synthetic Assets and Derivatives: Pyth’s data is used to track underlying assets for synthetic asset creation and derivative pricing.

- Risk Management: Financial institutions can use Pyth’s data to track exposure and mitigate risks in real-time.

- Insurance Protocols: Real-time asset pricing helps ensure that payouts and claims are accurate.

History of Pyth Network (PYTH)

Pyth Network was founded with the goal of solving the data limitations that exist within the blockchain and DeFi space. By directly sourcing market data from top exchanges, market makers, and financial institutions, Pyth offers a new standard for accuracy and reliability in oracles.

Since its launch in 2021, the network has quickly grown to become the largest and most trusted first-party oracle solution, securing over $1 billion in total value and supporting more than 250 applications. Pyth’s success has enabled it to process over $100 billion in trading volume, cementing its role as a critical infrastructure provider for the decentralized finance ecosystem.

Can I Use Pyth Network for My Application?

Yes! Pyth Network is permissionless, meaning that any developer or decentralized application can integrate its price feeds without needing approval. Whether you’re building a trading platform, lending protocol, or any other dApp requiring accurate real-time data, Pyth provides the tools and infrastructure to help you integrate reliable, low-latency price feeds seamlessly.

Pyth Network (PYTH) has rapidly established itself as a cornerstone of the DeFi ecosystem, providing decentralized applications with fast, reliable, and secure market data. Its first-party oracle system, built on trusted data from top financial institutions, ensures the integrity and accuracy of the information used by smart contracts. With over $1 billion in value secured and more than 250 applications already integrated, Pyth is positioning itself as the go-to solution for real-time, high-fidelity market data across blockchains.

علي عبده محمدجروب –

اليمن

Harran –

Good provides 350+ low