About AEVO

What is Aevo?

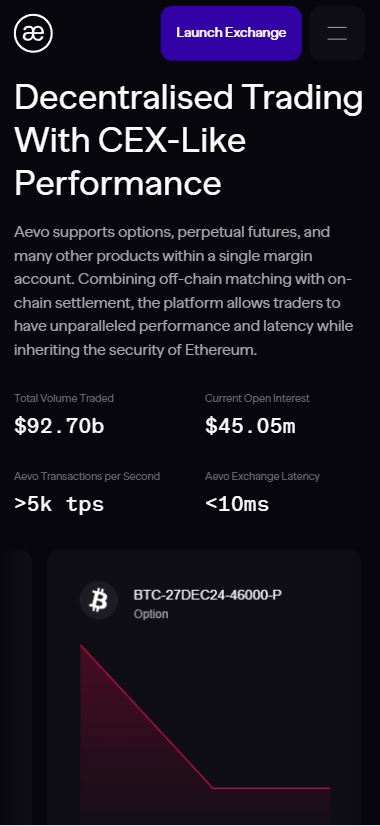

Aevo (formerly known as Ribbon Finance) is an Ethereum Layer-2 application chain built using the OP Stack. It functions as an order-book-based decentralized exchange (DEX), enabling users to trade assets on Ethereum in a more scalable and efficient manner. Aevo operates as a Rollup-as-a-Service (RaaS) platform, in collaboration with Conduit, a provider that facilitates Rollup deployment. The Aevo Rollup batch processes transactions, which are then posted on Ethereum periodically (every hour) to ensure security and immutability. One of the unique features of Aevo is that it eliminates traditional gas fees, making trading more accessible and cost-effective for users.

How does Aevo work?

Aevo leverages the OP Stack, an open-source stack developed by Optimism to build and operate Layer-2 rollups. Here’s how Aevo works:

- Order-Book-Based DEX:

- Unlike automated market makers (AMMs), Aevo uses an order-book model, where buyers and sellers place orders, and matching occurs on-chain. This model can offer more precise control over trades, especially for professional traders.

- Rollup Architecture:

- Aevo is a rollup—a Layer-2 scaling solution built on top of Ethereum. It processes transactions off-chain and periodically batches them, posting the bundled transactions onto the Ethereum mainnet. This reduces congestion on Ethereum while still ensuring the security of the Ethereum network.

- Sequencer and Batching:

- A sequencer managed by Conduit orders transactions in a sequence. The transactions are then batched and submitted to Ethereum every hour. This batching process ensures efficiency and faster transaction finality.

- Dispute Period:

- After transactions are batched and posted, a 2-hour dispute period exists where users can challenge the validity of transactions. If no disputes are raised, the transactions are finalized on Ethereum. If disputes are raised, they are resolved during the dispute period before final confirmation.

- Deposit and Withdrawal:

- Users can deposit and withdraw assets such as USDC, USDT, ETH, and WBTC from the Ethereum mainnet, as well as from other Layer-2 networks like Optimism and Arbitrum.

- No Gas Fees:

- One of Aevo’s key features is that there are no gas fees on the Aevo Rollup. This is possible because the gas fees are absorbed by the protocol itself, making transactions more user-friendly.

What are the potential use cases for Aevo?

Aevo is positioned as an efficient and scalable platform for decentralized trading. Its potential use cases include:

- Decentralized Trading:

- Aevo offers a decentralized order book that enables users to trade various assets without relying on centralized exchanges. The platform provides improved transparency, security, and privacy compared to traditional exchanges.

- Efficient Ethereum Scaling:

- By leveraging Ethereum Layer-2 rollups, Aevo can handle high throughput while reducing the load on the Ethereum network. This makes it ideal for high-frequency trading and other use cases that require rapid transaction finality.

- Zero-Gas Trading:

- Since Aevo eliminates gas fees on the Rollup, it allows traders to execute trades more efficiently without worrying about fluctuating Ethereum gas costs. This is particularly beneficial for small or frequent trades.

- Cross-Layer-2 Asset Movement:

- With its ability to integrate deposits and withdrawals from Optimism and Arbitrum, Aevo provides interoperability between Ethereum Layer-2 solutions, enhancing liquidity and asset mobility across different Layer-2 ecosystems.

- Advanced Trading Features:

- Aevo’s order-book model allows for features like limit orders, stop-loss orders, and other advanced trading options that can attract professional traders seeking more control over their positions.

What is the history of Aevo?

Aevo was originally launched as Ribbon Finance, a decentralized finance (DeFi) platform, before rebranding to Aevo and shifting its focus to become an Ethereum Layer-2-based order-book DEX. The decision to use the OP Stack and operate as a Rollup-as-a-Service was aimed at providing scalability and efficiency for decentralized trading. Aevo’s collaboration with Conduit to manage the rollup infrastructure was a significant milestone in its development, as it allowed the platform to scale while maintaining the security and decentralization inherent in Ethereum. By integrating zero gas fees, Aevo has positioned itself as an attractive platform for users seeking a low-cost, high-performance decentralized exchange.

Harran –

👍

Eyad –

good