About Openocean

OpenOcean: The Ultimate DEX Aggregator for Efficient Crypto Trading

OpenOcean is a decentralized exchange (DEX) aggregator protocol designed to offer the most efficient and cost-effective crypto trading experience. By aggregating liquidity from multiple decentralized exchanges across various blockchains, OpenOcean provides users with the best prices, low slippage, and fast settlement for trades. OpenOcean’s intelligent routing algorithm ensures that users get the best deal by splitting trades across different exchanges and chains when necessary.

Key Features of OpenOcean:

1. Multi-Chain Aggregation

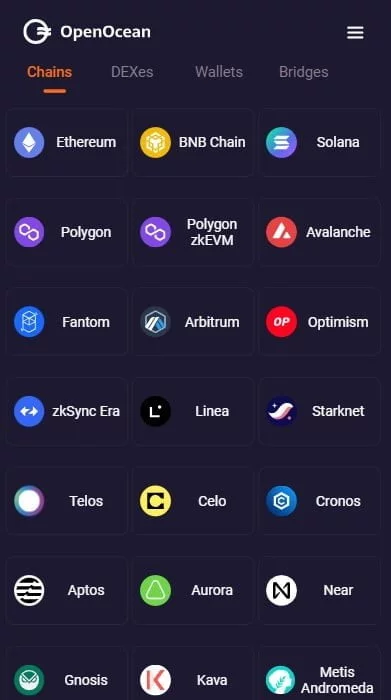

OpenOcean aggregates liquidity from major decentralized exchanges (DEXes) across multiple blockchains, including:

- Ethereum

- Layer 2 solutions (Arbitrum, Optimism)

- BNB Chain

- Solana

- Avalanche

- Fantom

- Gnosis And more…

It is the first DEX aggregator on several prominent chains, such as BNB Chain, Avalanche, Fantom, Solana, and Gnosis, and continues to expand to additional blockchains based on community needs.

2. Cross-Chain Swaps

OpenOcean supports cross-chain swaps by utilizing cross-chain protocols. As the infrastructure matures, OpenOcean plans to offer direct cross-chain transactions without requiring bridging or intermediary steps.

- Cross-chain support means that users can trade assets between different blockchain ecosystems, unlocking greater liquidity and trading opportunities across fragmented markets.

3. Intelligent Routing Algorithm

OpenOcean uses an intelligent routing algorithm that searches for the best price and minimizes slippage by splitting trades across different liquidity sources. This ensures that users get the most efficient route for their trades, even if it means sourcing liquidity from multiple DEXes on different blockchains.

4. User-Friendly & Free to Use

- OpenOcean is free to use. Users only need to pay the regular blockchain gas fees and exchange fees charged by the underlying exchanges.

- The platform’s interface is designed to be intuitive and accessible for both beginners and advanced traders.

- OpenOcean’s API and customized trading interfaces are available for institutional and professional traders, offering tools for automated arbitrage, quantitative trading, and asset management strategies.

5. Derivatives Aggregation and Wealth Management

In addition to swaps, OpenOcean plans to aggregate derivatives products from DeFi markets, helping users access perpetual futures, options, and other derivative assets. The platform will also offer wealth management services, allowing users to automate their asset management and investment strategies within DeFi.

- This will include the aggregation of on-chain derivatives products and providing tools for arbitrage and CTA trading strategies for institutional investors and funds.

6. OpenOcean Token (OOE)

OpenOcean has its own utility and governance token — OOE. The OOE token plays an important role in:

- Governance: Token holders can vote on proposals related to platform upgrades, product development, and other important decisions.

- Utility: OOE is used to access various services on the platform, including trading incentives, reduced fees, and more.

7. Global Liquidity

OpenOcean aggregates liquidity from across the DeFi ecosystem, ensuring that users can execute their trades with deep liquidity. This reduces the risk of slippage and makes the platform suitable for both small individual investors and large institutions.

How OpenOcean Works:

- Aggregation of Liquidity: OpenOcean sources liquidity from a wide range of DEXes across different blockchains, ensuring users have access to the most liquid pools.

- Price Discovery: OpenOcean’s intelligent routing finds the best prices across these platforms. It may split a single trade across multiple exchanges and liquidity sources to minimize slippage and maximize efficiency.

- Cross-Chain Functionality: With OpenOcean’s support for cross-chain swaps, users can trade assets across different blockchains seamlessly. The platform ensures efficient liquidity and minimal fees by optimizing the trade routing.

- Derivatives and Investment Services: As part of its expansion, OpenOcean will provide derivatives aggregation, and tools for automated wealth management, giving users access to more advanced DeFi products and services.

Target Audience:

- Retail Traders: OpenOcean provides an easy-to-use, cost-effective platform for retail traders to access the best liquidity across multiple blockchains and DEXes.

- Institutional Traders & Funds: OpenOcean offers APIs, customized interfaces, and tools for professional traders, funds, and investment institutions to implement automated strategies like quantitative arbitrage and automated asset management.

- Developers and Protocol Builders: OpenOcean’s aggregation infrastructure provides a foundation for developers to build custom strategies, arbitrage bots, or other DeFi solutions using its liquidity and routing services.

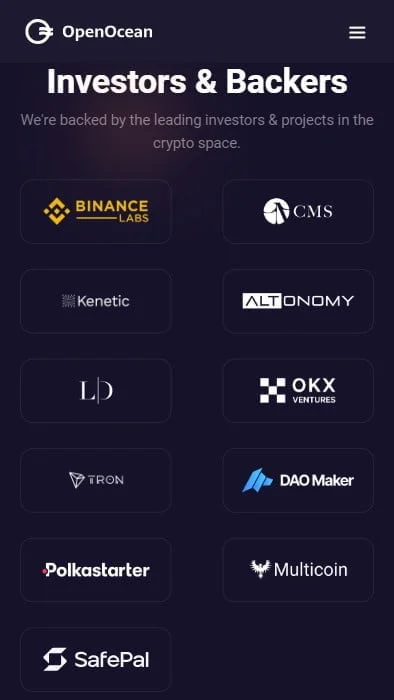

Strategic Partnerships and Investments:

OpenOcean has attracted significant strategic investment from notable players in the crypto and finance industry, including:

- Binance (leading the strategic round)

- Multicoin Capital

- LD Capital

- CMS

- Kenetic

- Altonomy

- Huobi Ventures Blockchain Fund

Other investors include prominent names like DAOMaker, OKEx Blockdream Ventures, FBG, TRON Foundation, and Altonomy.

Vision for the Future:

OpenOcean aims to be the ultimate aggregator for all types of crypto trading, connecting the fragmented DeFi and CeFi markets and increasing capital efficiency. The platform envisions:

- Making it easy for both small individual investors and large institutions to access the best trading prices and execute efficient trades.

- Aggregating all types of crypto trading products (including spot, derivatives, and wealth management) into a single, easy-to-use platform.

- Enhancing liquidity and creating a more connected and efficient crypto ecosystem for all users.

OpenOcean stands out as one of the most efficient and comprehensive DEX aggregators in the DeFi space. Its multi-chain support, cross-chain swaps, intelligent routing, and expanding features like derivatives aggregation and wealth management make it a powerful tool for all types of traders, from beginners to institutional investors. With OCE as a utility and governance token, OpenOcean continues to evolve into a one-stop solution for seamless, cost-effective, and efficient crypto trading.

Anthonywax –

NFT news

Harran –

nice

Eyad –

good

Jemer Jimenez –

i Like it !