About Osmosis (OSMO)

What is Osmosis (OSMO)?

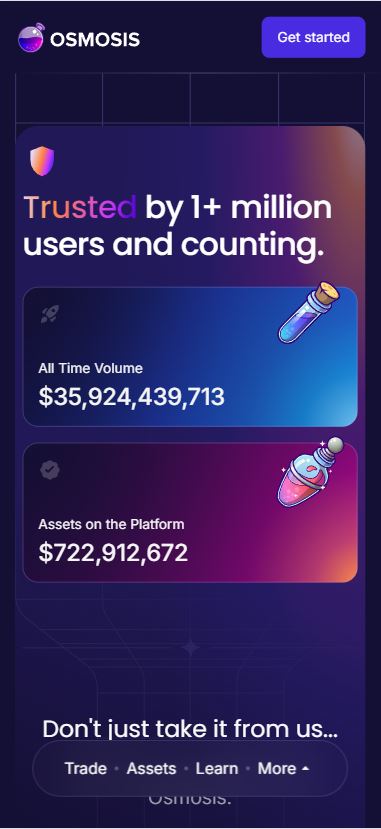

Osmosis (OSMO) is a decentralized exchange (DEX) built for the Cosmos ecosystem, which facilitates the exchange of assets across multiple blockchains. Osmosis operates as a Layer 1 App Chain, meaning it has its own blockchain dedicated to decentralized finance (DeFi) applications. Osmosis provides users with a suite of DeFi products, including automated market makers (AMMs), concentrated liquidity, lending platforms, perpetual markets, and liquidity vaults.

OSMO is the native utility token of the Osmosis protocol and is used for governance, staking, and paying for gas fees within the ecosystem. Osmosis enables a range of cross-chain interoperability with over 80 app chains within the Cosmos network, as well as external blockchains like Ethereum, Bitcoin, Polkadot, Avalanche, and Solana. The protocol’s unique features allow for more flexible liquidity provision and greater control over the decentralized exchange’s operations compared to other DEXs.

How Does Osmosis (OSMO) Work?

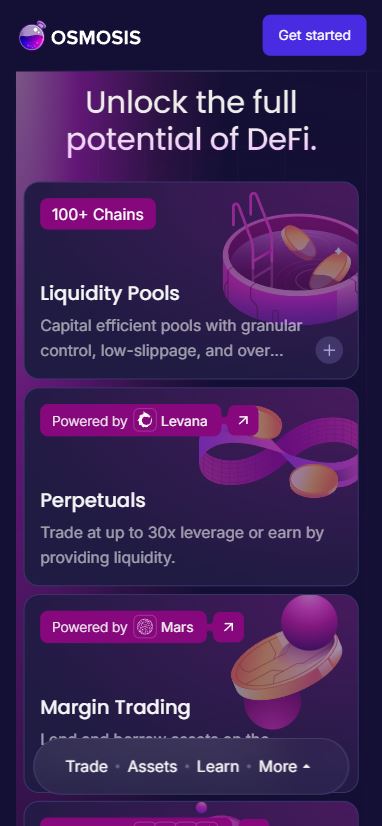

Osmosis offers several key features that distinguish it from other decentralized exchanges:

- Customizable Liquidity Pools:

- One of Osmosis’ main innovations is its ability to allow liquidity providers (LPs) to create customizable liquidity pools. Unlike traditional AMMs (Automated Market Makers) where LPs provide liquidity in a two-token pool with equal ratios, Osmosis enables LPs to create pools with multiple tokens and unequal token ratios. This allows for greater flexibility and better control over liquidity distribution.

- LPs can also adjust important parameters, such as slippage tolerance and transaction fees, to optimize their returns and mitigate risks. This flexibility allows for more tailored strategies in managing liquidity.

- Superfluid Staking:

- Osmosis introduces the concept of Superfluid Staking, which enhances the security of its Proof-of-Stake (PoS) consensus model. Superfluid Staking allows users to stake their OSMO tokens while simultaneously using them as liquidity in Osmosis’ pools. This provides an additional incentive for liquidity providers, as they can earn staking rewards while still contributing to liquidity pools.

- Inter-Blockchain Communication (IBC):

- Osmosis is deeply integrated into the Cosmos ecosystem, which uses the Inter-Blockchain Communication (IBC) protocol to allow cross-chain interoperability. This means that Osmosis can connect and interact with over 80 sovereign blockchains within the Cosmos ecosystem, as well as assets from Ethereum, Bitcoin, Polkadot, Avalanche, and Solana.

- Through IBC, Osmosis enables seamless and decentralized exchanges across different blockchain ecosystems, significantly improving the overall liquidity and accessibility of cross-chain assets.

- AMMs as Serviced Infrastructure:

- Osmosis provides AMMs as serviced infrastructure for other creators. This means that developers can build and deploy their own AMMs using Osmosis’ robust infrastructure, while defining the bonding curve value function for liquidity pools. This opens up opportunities for more innovative AMM designs and liquidity protocols on the Osmosis platform.

- Governance and Staking:

- The OSMO token is used for governance in the Osmosis network. Token holders can participate in the decision-making process by voting on proposals that influence the protocol’s development, such as changes to liquidity pools, fees, or the introduction of new features.

- OSMO is also used for staking, where holders can lock their tokens to contribute to network security. Stakers are rewarded with additional OSMO tokens for helping to validate transactions and maintain the integrity of the network.

- Transaction Mempool Shield:

- Osmosis aims to mitigate the problem of Miner Extractable Value (MEV), a phenomenon where miners or validators can extract value by front-running or reordering transactions for profit. Osmosis addresses this issue by introducing a transaction mempool shield with threshold encryption. This approach aims to create a fairer and more transparent transaction environment on the platform.

What Are the Potential Use Cases for Osmosis (OSMO)?

Osmosis offers a wide range of functionalities for DeFi users and developers, including:

- Cross-Chain Asset Swaps:

- Osmosis allows for seamless asset swaps between different blockchains, both within the Cosmos ecosystem and external chains like Ethereum, Polkadot, and Bitcoin. This cross-chain interoperability enhances liquidity and creates a more unified decentralized trading experience.

- Liquidity Provision and Yield Farming:

- Users can provide liquidity to Osmosis’ pools and earn transaction fees as rewards. With customizable pools and flexible parameters, liquidity providers can optimize their yield farming strategies.

- Superfluid Staking allows liquidity providers to simultaneously stake their OSMO tokens and contribute to the liquidity pools, earning both staking rewards and trading fees.

- Decentralized Lending and Perpetual Markets:

- Osmosis supports decentralized lending and perpetual trading markets, allowing users to borrow and lend assets without relying on traditional intermediaries. This feature can be utilized for yield generation, leveraged trading, and more.

- Governance Participation:

- As the governance token of Osmosis, OSMO enables holders to participate in the platform’s decision-making process. This allows the community to have a say in the evolution of the protocol, from changes in liquidity parameters to the introduction of new features and governance structures.

- AMM Innovations:

- With the ability to create custom liquidity pools, Osmosis enables developers to innovate with new AMM designs. These innovations can lead to more efficient liquidity distribution, lower slippage, and improved user experiences on decentralized exchanges.

- Reducing Miner Extractable Value (MEV):

- Osmosis addresses the issue of MEV by introducing its transaction mempool shield, which aims to reduce the negative impacts of MEV on users. This is important for ensuring a fairer trading environment and minimizing the exploitation of traders through front-running or transaction manipulation.

What is the History of Osmosis (OSMO)?

Osmosis was launched by a group of core contributors from prominent Cosmos teams, including:

- Sunny Aggarwal and Dev Ojha from Sikka Validator and Tendermint.

- Josh Lee and Tony Yun from Keplr, the popular Cosmos Interchain Wallet.

The project received significant support from Paradigm, a well-known digital asset firm that has invested in numerous blockchain and DeFi projects. Osmosis operates on a sovereign Proof-of-Stake blockchain with its own validator set, independent of any parent blockchain.

Tokenomics of OSMO

- Total Supply: The total supply of OSMO tokens is capped at 1 billion.

- Thirdening Schedule: Osmosis follows a “thirdening” token release schedule, where the distribution of OSMO tokens is reduced by a third each year, ensuring a gradual reduction in the inflation rate over time.

Harran –

excellent