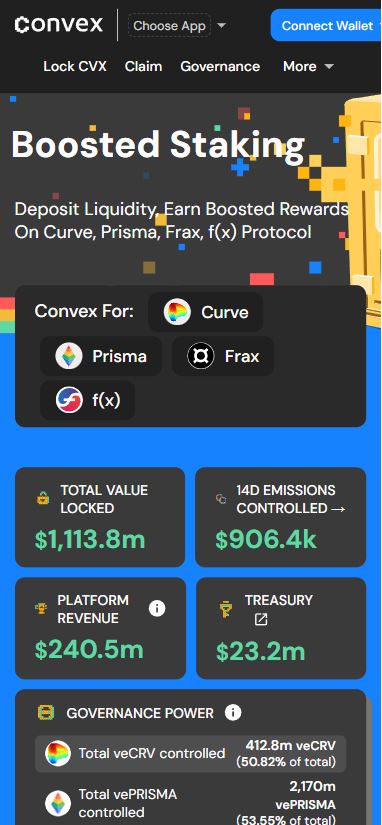

What is Convex? (CVX)

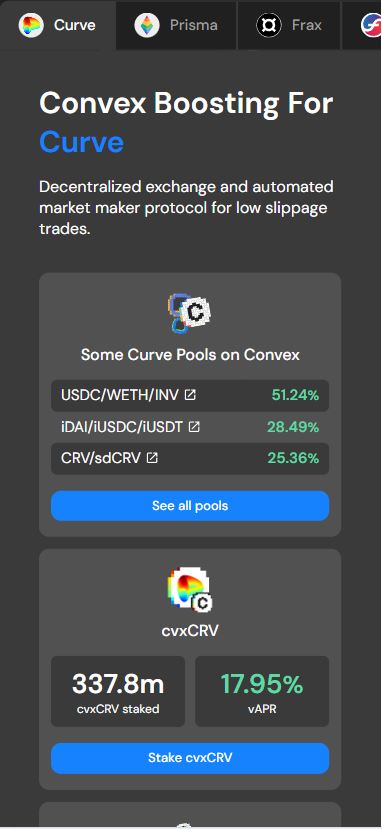

Convex Finance is a decentralized finance (DeFi) platform designed to optimize yields and enable liquidity mining rewards for the Curve protocol. Officially launched in May 2021, Convex allows users to earn boosted Curve (CRV) rewards by staking their tokens, while also providing governance rights through the CVX token. By leveraging Curve’s liquidity pools and reward structure, Convex enables users to maximize their returns from providing liquidity to Curve.

Convex operates as a yield optimizer specifically built for the Curve protocol, a decentralized exchange (DEX) liquidity pool optimized for stablecoin swaps on Ethereum. Curve (CRV) token holders and liquidity providers (LPs) can stake their CRV tokens via Convex to earn additional rewards in the form of CVX tokens and a share of boosted CRV rewards.

How Does Convex Work?

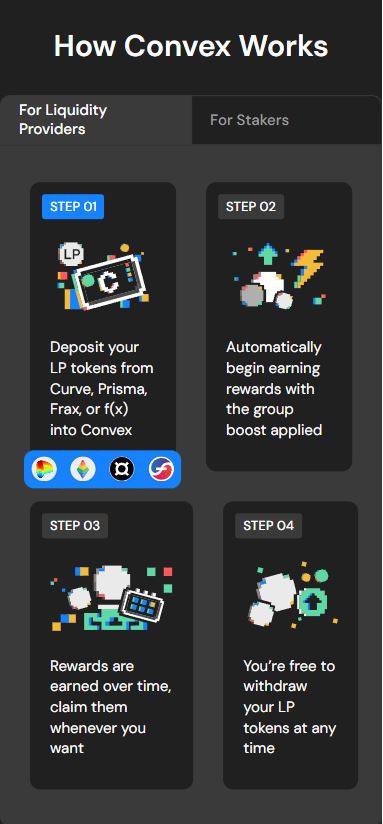

Convex allows Curve liquidity providers (LPs) to boost their rewards without needing to lock up their CRV tokens for long periods. Typically, Curve LPs earn CRV rewards, but by staking their CRV on Convex, they can increase their yield without having to lock it for extended periods.

Convex’s process works as follows:

- Staking CRV through Convex: Users stake their CRV tokens on Convex to earn CVX and boosted CRV rewards.

- Boosted Rewards: Convex optimizes CRV rewards, providing a boost to users’ earnings from Curve’s liquidity pools.

- CVX as a Reward: As an incentive, users also earn Convex’s native CVX token for staking on the platform.

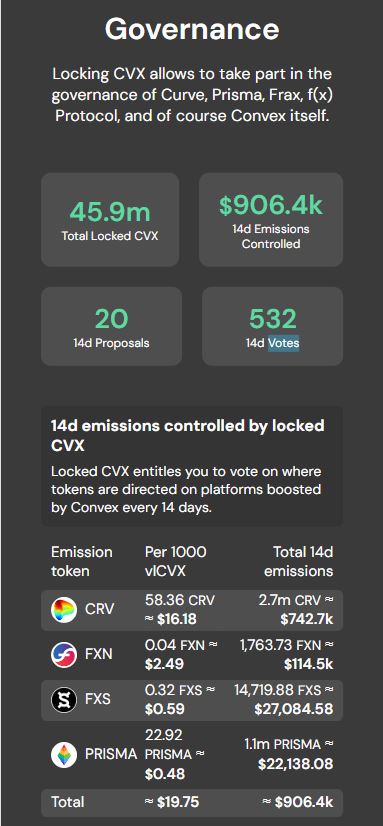

- Governance: CVX tokens are used for voting on how the Convex platform allocates rewards, allowing users to participate in the governance of the protocol. However, to vote, users must lock their CVX for a certain period.

In essence, Convex enhances the experience for users of Curve Finance by optimizing the rewards and simplifying the staking process, while allowing governance participation through CVX tokens.

What Are the Key Features of Convex?

- Boosted Curve Rewards: Users who stake CRV via Convex receive a boost on their CRV rewards, significantly increasing the yield they earn from liquidity provision.

- CVX Token: The CVX token serves multiple purposes within the Convex ecosystem, including staking for rewards and governance. CVX holders can vote on proposals related to token allocation and the future direction of the platform.

- Liquidity Mining Rewards: In addition to boosting CRV rewards, users can earn CVX tokens as part of the platform’s liquidity mining strategy.

- Governance Rights: CVX token holders can participate in the governance of Convex by voting on protocol upgrades, including the allocation of rewards to liquidity providers and other adjustments to the platform’s functionality.

Who Created Convex?

Convex was created by a pseudonymous team or individual known as C2tp. Similar to Bitcoin’s creator Satoshi Nakamoto, the identity of Convex’s founders remains undisclosed. It is speculated that the founder(s) have a background in software development, although this has not been officially confirmed.

Convex was launched in May 2021 and was whitelisted on Curve in April 2021, following a proposal that allowed Convex to participate in Curve’s governance. This whitelisting was a significant step as it enabled Convex to manage a substantial portion of Curve’s CRV tokens, which gave it a strong influence in Curve’s governance and allowed it to custody a large number of Curve’s liquidity provider tokens.

Convex Tokenomics (CVX)

The CVX token has a maximum supply of 100 million CVX tokens, distributed as follows:

- 50% allocated for rewarding Curve liquidity providers.

- 25% allocated for liquidity mining over a period of four years.

- 9.7% held in the Convex treasury for development and future project needs.

The CVX token plays a crucial role in the platform’s governance and reward distribution. Users can stake CVX to earn additional rewards, and those who lock their CVX tokens can participate in important decisions regarding token allocations and the platform’s future.

Reviews

There are no reviews yet.