What is Numeraire? (NMR)

Numeraire (NMR) is the native cryptocurrency of Numerai, a decentralized hedge fund that leverages artificial intelligence and data science to make market predictions and execute trades on the Ethereum blockchain. The platform aims to democratize the hedge fund industry by allowing a global network of data scientists to contribute their predictive models and earn rewards for their accuracy, all while using cryptocurrency as a staking mechanism to ensure correctness and accountability.

The core idea of Numeraire is that data scientists from around the world can submit stock market predictions and, in return, stake NMR tokens on the likelihood of those predictions being accurate. If their predictions are correct, they earn more NMR tokens; if they’re wrong, their staked tokens are burned. This incentivizes the creation of highly accurate and innovative models for predicting financial markets.

Key Features of Numeraire

- Hedge Fund Based on AI and Data Science:

- Numerai operates a hedge fund that trades equities based on predictions made by a decentralized community of data scientists. These predictions are aggregated and used to inform the fund’s trading algorithms.

- Decentralized Prediction Market:

- The platform invites data scientists to submit market predictions in the form of algorithms or models. Participants stake NMR on their predictions, and those who contribute accurate predictions earn more tokens.

- Staking with NMR:

- Numeraire (NMR) is used as the primary staking mechanism for participants. Data scientists stake NMR tokens on their predictions and earn more NMR if they are correct. If their predictions are wrong, the staked NMR tokens are burned.

- Two Key Applications:

- Tournament: A weekly competition where data scientists submit their stock market predictions and stake NMR tokens on their accuracy. Payouts are determined by how well a participant’s predictions align with actual market performance.

- Signals: An ongoing feature where users can upload stock market strategies, such as technical analysis or sentiment analysis, for specific stocks. Participants earn NMR based on the success of their predictions.

- Erasure Protocol:

- The Erasure protocol, built on Ethereum, is the smart contract infrastructure that underpins Numerai’s ecosystem. This protocol allows for secure staking and ensures that rewards are only given to those whose predictions are correct. Incorrect predictions result in the burning of the staked NMR.

How Does Numeraire (NMR) Work?

Numeraire is designed to harness the power of data scientists to create the best possible predictive models for stock market behavior, and incentivize participants based on the quality of their contributions. Here’s how it works:

1. Numerai Tournament (Weekly Competition)

- The Tournament is a weekly competition where data scientists and analysts submit their market predictions in the form of algorithms or models.

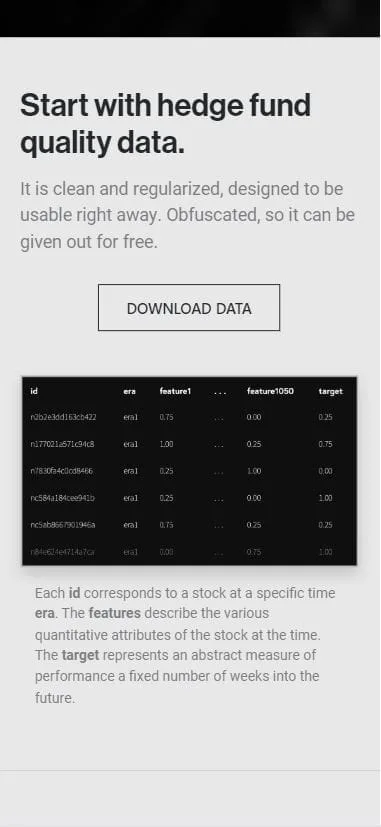

- Participants predict the future price movements of stocks in Numerai’s dataset. This dataset includes information on 5,000+ stocks and various market factors.

- Participants stake NMR tokens on their predictions, essentially betting on the likelihood of their models’ accuracy.

- At the end of the week, the models’ accuracy is evaluated, and those who staked on correct predictions earn more NMR tokens. Those who are wrong have their staked tokens burned (destroyed).

2. Numerai Signals (Ongoing Strategy Application)

- Numerai Signals is an application where data scientists and traders upload specific stock market strategies.

- Users submit signals on specific stocks, detailing the target stock price or prediction (e.g., buy or sell) based on factors like technical analysis, social media sentiment, or financial ratios.

- Similar to the Tournament, users stake NMR tokens on their predictions, and rewards are given to those who provide accurate signals, while incorrect predictions result in the burning of staked NMR.

3. Meta Model (AI Aggregation)

- The predictions from all participants are aggregated into an AI model known as the meta model. This meta model combines the best predictions from all contributors to create an optimized prediction for the hedge fund’s algorithm.

- The meta model informs the trading decisions of Numerai’s hedge fund, allowing it to trade on the stock market with the goal of maximizing returns based on the collective wisdom of data scientists.

4. Erasure Protocol (Decentralized Staking & Rewards)

- The Erasure Protocol is a set of smart contracts built on Ethereum that automates the staking and rewarding process. It enforces the rules of staking, ensures that rewards are distributed only for correct predictions, and manages the burning of tokens for inaccurate ones.

- This protocol ensures the decentralization of Numerai, eliminating the need for a centralized authority to validate or enforce outcomes.

5. NMR as the Utility Token

- NMR is used to:

- Stake on predictions in both the Tournament and Signals.

- Earn rewards for accurate predictions.

- Govern the Numerai network, as token holders can vote on changes to the protocol, data, and governance parameters.

How to Use Numeraire (NMR)?

- Sign Up:

- Create an account on the Numerai platform and connect your Ethereum wallet (such as MetaMask).

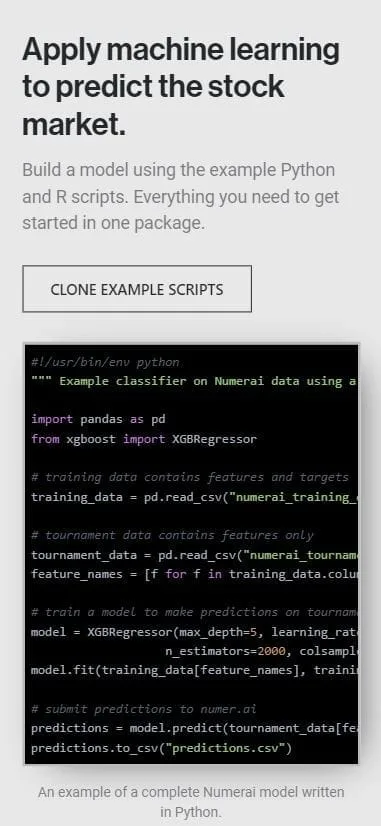

- Participate in the Tournament:

- Submit your predictions: Use your data science model to predict stock market outcomes for the Numerai dataset.

- Stake NMR: Stake NMR tokens on your predictions to show confidence in your model’s accuracy.

- Participate in Numerai Signals:

- Submit stock market strategies (signals) for specific stocks and stake NMR based on your confidence in the prediction.

- Earn Rewards or Risk Losses:

- If your predictions are correct, you’ll earn NMR tokens. If incorrect, your staked NMR will be burned.

- Governance:

- Stake NMR to participate in governance decisions. Vote on important matters that could affect the platform, such as protocol upgrades or changes to staking mechanisms.

Anthonywax –

Bitcoin news updates