AAVE has experienced a decline for the second consecutive week, mirroring the broader downtrend in the altcoin market as tariff risks continue to impact the sector. The token dropped to a low of $196.4, its lowest level since November 25, and is currently 50% below its peak for the year. Despite these challenges, several factors suggest that AAVE could surge back to its all-time high of $666, representing a 170% increase from its current price.

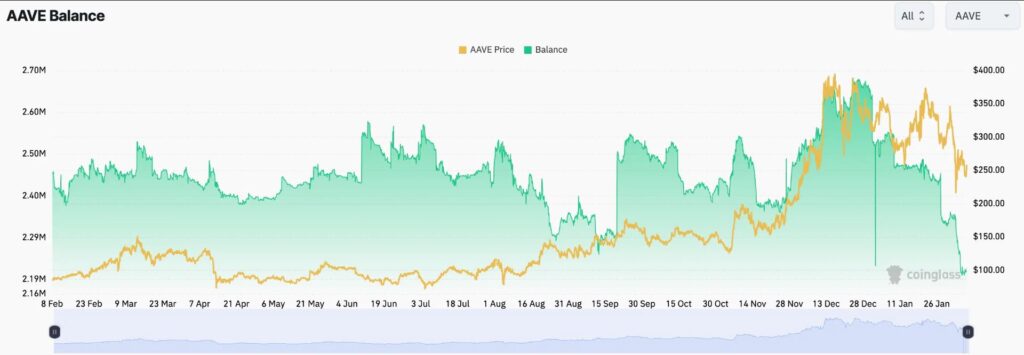

One of the main positive signals for AAVE is the growing accumulation among investors. Data from Coinglass shows that AAVE’s balances on exchanges have fallen to their lowest level in years, from 2.67 million in December to 2.2 million this past Friday. This drop suggests that investors are holding their tokens rather than selling them, which is a positive indicator. Typically, when balances rise, it suggests selling pressure, but this decrease signals that investors are confident about AAVE’s future, which could provide upward price momentum.

AAVE continues to be the largest and most profitable lending and borrowing platform in the decentralized finance (DeFi) sector. With over $20 billion in assets, the platform remains a leader in the industry. AAVE has seen its annualized fees exceed $721 million, and as of this year, it has earned over $103 million in fees. Furthermore, AAVE successfully managed over $201 million in liquidations without accumulating bad debt, showcasing the platform’s strength during market volatility. This solid performance helps reinforce confidence in AAVE’s long-term stability and growth potential.

The network is also expanding its reach, which could positively affect its price. More than 440 million USDS stablecoins have been deposited into AAVE, reflecting growing trust in the platform. AAVE has also moved to Base, Coinbase’s blockchain network, and a vote is currently underway to enable the platform on Linea. These strategic expansions suggest that AAVE’s ecosystem is growing, attracting more liquidity, and increasing its user base, all of which are key factors that could contribute to a price increase.

From a technical perspective, AAVE is showing signs of potential growth. The token has formed a cup and handle chart pattern, with the upper boundary at $400. The recent pullback is part of the handle phase, which typically precedes a strong upward movement. Additionally, the formation of a hammer candlestick pattern suggests that the handle phase is nearing its end. If the pattern continues, AAVE could surge to $765, representing a 200% increase from its current price, as the bullish technical indicators suggest strong growth ahead.